“Samsung is Back in the HBM Race”, Says Co CEO as HBM4 Momentum Builds and 2027 Share Flip Is Forecast

Samsung is signaling renewed confidence in high bandwidth memory, positioning its HBM4 roadmap as a turning point after a period where it ceded momentum to rivals during the HBM3 cycle. In a New Year address, Samsung co CEO and chip chief Jun Young hyun said customer sentiment around HBM4 has improved to the point where some have told the company that Samsung is back, according to remarks reviewed by Reuters. Jun also cautioned that there is still work to do to further improve competitiveness, which reads as an acknowledgement that the market is not awarding share on promises alone, but on validated thermals, yield stability, and supply reliability at scale.

This shift matters because Samsung’s HBM narrative over the last few quarters has been defined by recovery mode. As HBM demand accelerated with AI training and inference platforms, the company faced questions around yield rates and thermal behavior that slowed certification progress with major clients. The current messaging suggests Samsung believes those hurdles are being addressed through an internal strategy pivot, tighter execution, and earlier node development alignment. Samsung’s lead angle for HBM4 is tied to being ahead on 1c DRAM development and to deeper partner coordination, including work with NVIDIA, which Samsung is framing as a foundation for a stronger supply chain position.

On the product side, Samsung has been associated with HBM4 modules targeting 11 Gbps class pin speeds, a performance headline that is increasingly important as GPU and accelerator roadmaps chase bandwidth density without exploding power budgets. If Samsung can combine that with competitive pricing and stable volume, it becomes a credible alternative lane for AI customers that want dual sourcing options instead of single supplier exposure.

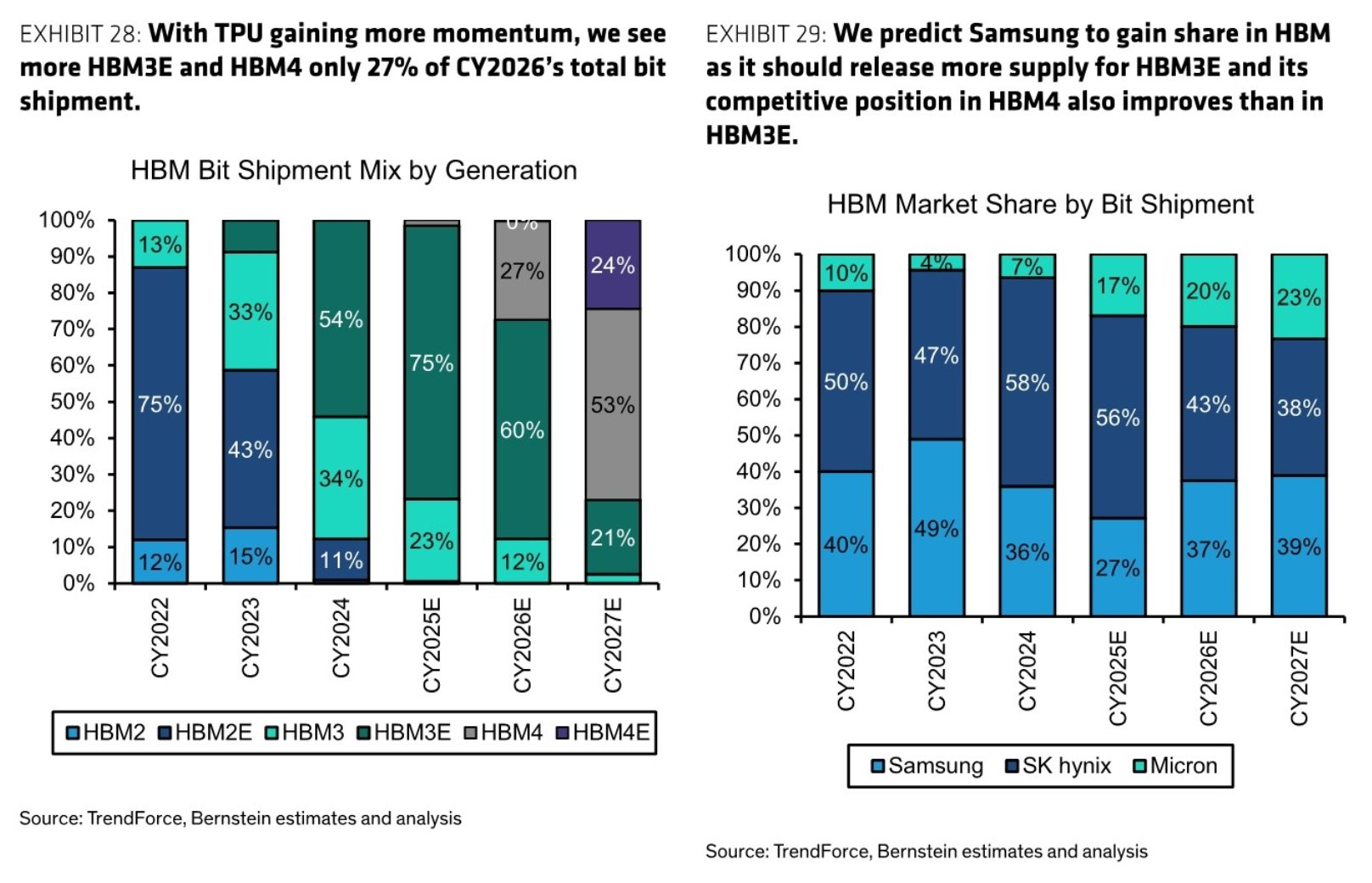

Market share expectations are also starting to reflect that possibility. A Bernstein HBM model shared by jukan05 on X projects Samsung’s HBM market share could surpass SK hynix by 2027. That is a meaningful forecast because it implies not only technical readiness but also commercial conversion, meaning customer adoption at real shipment scale rather than pilot programs. It also aligns with the broader macro reality that the AI buildout is large enough to lift all major memory suppliers in absolute revenue, even while market share leadership remains a competitive battleground.

The forward looking read is that HBM is moving into a phase where supply chain credibility is becoming as decisive as raw specs. If Samsung’s HBM4 execution meets customer qualification requirements and its pricing strategy holds, 2026 becomes the year the company re establishes itself as a top tier HBM supplier in practice, not just in press statements, with 2027 positioned as the moment where share leadership could meaningfully change hands.

Do you think Samsung can realistically overtake SK hynix on HBM market share by 2027, or will validation, thermals, and ramp discipline keep hynix in the lead even as Samsung improves?