TSMC US Fabs Drive Up Operating Costs, But the Strategic Value Goes Far Beyond Near Term Margins

TSMC is pushing deeper into United States manufacturing at a moment when semiconductor supply chains are being treated as strategic infrastructure, not just industrial capacity. The company is scaling its long range commitment around its Arizona footprint, and the broader plan discussed across industry circles spans wafer fabrication, advanced packaging, and research capability in the region. While that shift supports a wider diversification mandate, it also comes with a measurable cost premium that directly pressures gross margins when compared with Taiwan based production.

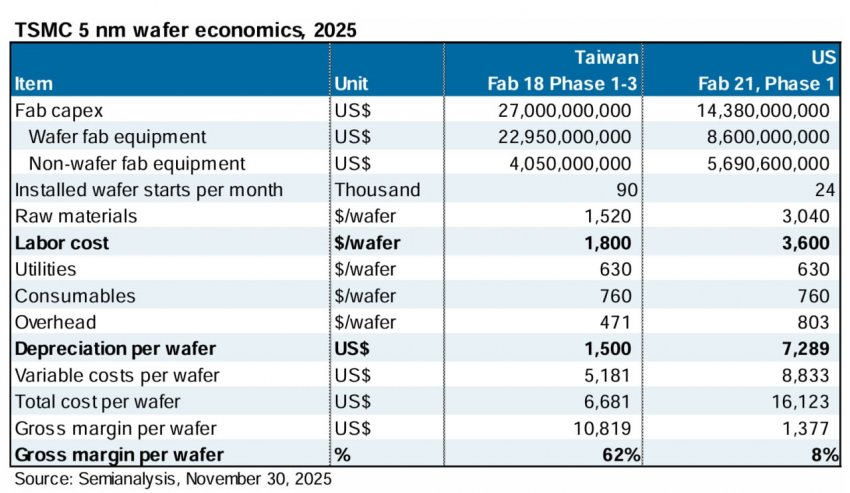

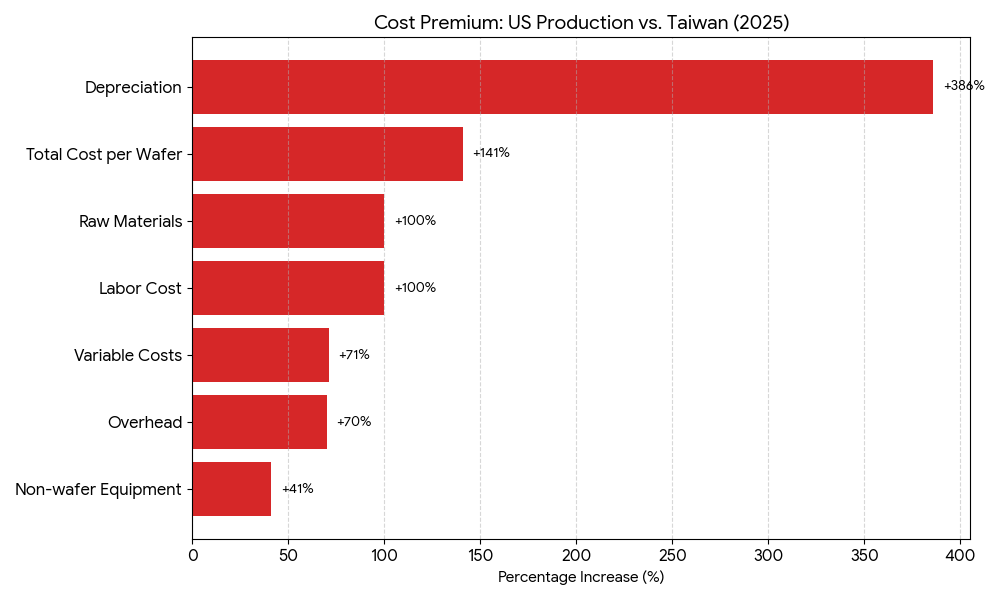

Based on operating cost statistics compiled by SemiAnalysis and shared by analyst Jukan, the cost structure for running fabs in the United States is materially higher, with labor expenses and depreciation per wafer standing out as primary drivers. You can view the referenced breakdown via Jukan on X. Depreciation is especially punishing in scenarios where the same class of tools and facilities are amortized across lower wafer output, effectively increasing the fixed cost burden each wafer carries. In simple business terms, the equipment and facility overhead does not scale down just because volume is lower, so per wafer economics become heavier, and margin resilience gets tested quarter by quarter.

Labor adds another layer of complexity. Staffing a leading edge fab is not only expensive, it also depends on deep operational discipline and rapid response culture. Morris Chang has previously highlighted how differences in work culture can translate into differences in turnaround time for urgent fixes, which matters in high utilization environments where every hour of downtime is a revenue and yield risk. When you combine labor intensity, training ramp requirements, and the premium cost of maintaining consistent operational tempo, it becomes clear why United States fab operations can dilute margins unless pricing and customer mix are carefully optimized.

This margin reality is also why leading edge wafer pricing remains a critical lever for TSMC. The market has already been discussing sustained price escalation dynamics around next generation nodes such as 2 nm, and higher operating costs outside Taiwan reinforce the logic that advanced node pricing will continue to reflect not only technology leadership but also the geographic cost base required to sustain diversified capacity.

Even with these headwinds, the larger purpose of United States expansion is not simply revenue. It is risk management, customer assurance, and geopolitical resilience. For large scale AI and high performance compute customers, the strategic priority is continuity of supply and reduced single region exposure. From a platform road map perspective, diversified capacity also helps customers align long term product planning with more stable procurement assumptions, which can be as valuable as a raw cost reduction in a world where delays can disrupt entire generation cycles.

The near term conclusion is straightforward. Operating costs in the United States are higher, and profitability can take a hit as utilization and scale mature. The long term conclusion is more important. TSMC is building optionality into the global semiconductor backbone, and that optionality is increasingly what the market is paying for.

Do you think customers will accept higher chip pricing to fund United States based capacity, or will they push harder for cost parity even if it slows diversification?