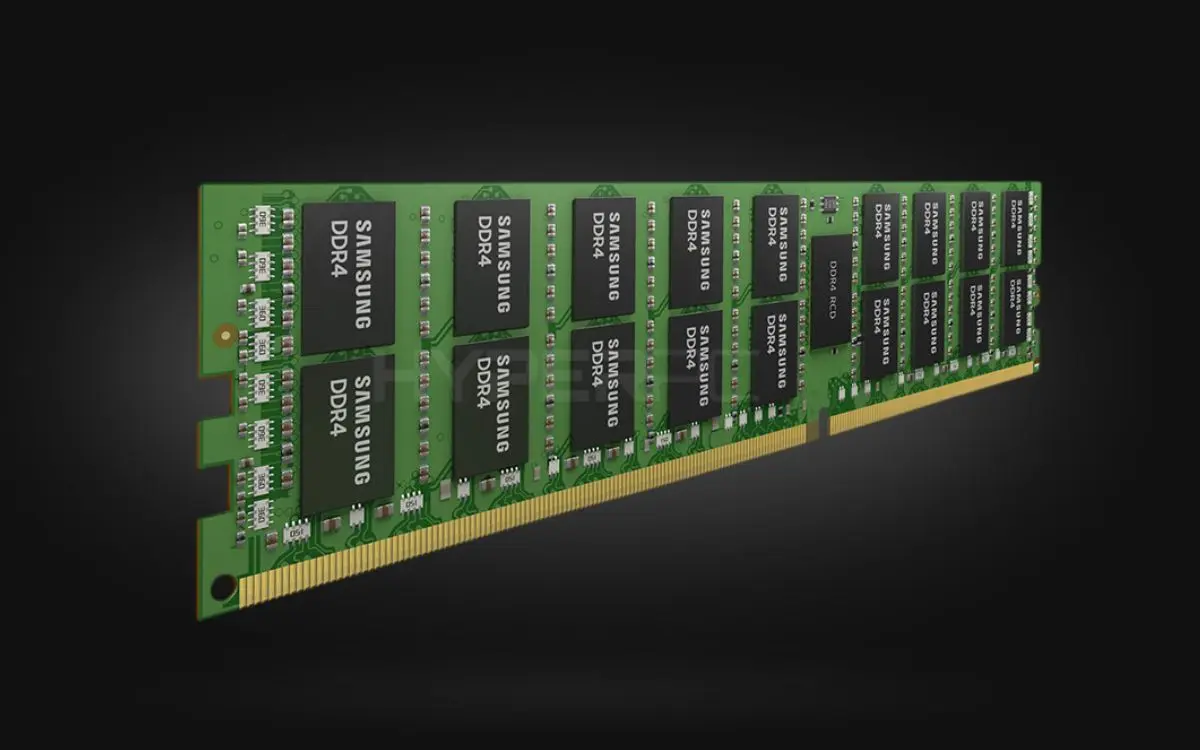

Samsung to Keep DDR4 Lines Running Longer, But Supply Is Being Reserved for Servers, Not PC Gamers

The DRAM supercycle continues to reshape the memory market, and the latest signal is clear: DDR4 is not disappearing as fast as many expected, but consumer builders should not assume this translates into relief for gaming PC upgrades.

According to a report from DigiTimes, Samsung plans to slow down the pace of DDR4 end of life production in the fourth quarter of 2025, then move into long term supply contracts with specific customers in the first quarter of 2026 under fixed supply conditions that cannot be cancelled or changed. The key detail is allocation: the report indicates DDR4 production will be directed toward server grade customers, not the mainstream PC channel.

That matters because DDR4 has recently been perceived as the practical pressure valve during DDR5 volatility. For a while, DDR4 pricing looked comparatively stable, and it helped keep budget and mid range builds viable, especially for platforms where DDR4 remained an option. If server demand pulls DDR4 capacity into locked contracts, DDR4 may stop behaving like the affordable fallback that gamers and DIY builders were hoping for.

The report also notes that Samsung is expected to offer Non Cancellable and Non Returnable contracts. Strategically, that is a supply chain control lever: it lets a supplier secure demand and stabilize planning while reducing the risk of customers pivoting away if pricing or availability shifts. In a market where AI infrastructure demand is distorting both general purpose DRAM and higher end memory pipelines, contracts like these can effectively firewall production away from the consumer channel and toward the customers with the strongest purchasing power and the most predictable volume commitments.

The broader implication is that the consumer market may remain a lower priority lane while AI and data center demand continues to absorb manufacturing capacity. Even if DDR4 stays in production longer than expected, the value does not automatically flow to gamers if the output is already pre allocated to enterprise buyers. The report also points to renewed interest in AMD AM4 as consumers scramble for upgrade paths that can avoid peak DDR5 costs, but that strategy only works if DDR4 remains accessible at sane pricing.

For PC gamers planning builds through 2026, the smart play is to treat DDR4 availability as a variable, not a guarantee. If more suppliers extend DDR4 production primarily for servers, the consumer channel could see tighter inventory, more price spikes, and less choice in popular capacities and speed bins, even though the technology itself is older.

Do you think the next 12 months will push more gamers back toward AM4 and DDR4 builds, or will most builders accept the DDR5 premium and move forward anyway?