Intel Foundry Keeps 14A as the Main Target for External Clients While 18A Stays on the Menu as a Secondary Option

Intel Foundry is still trying to land its biggest win condition: converting external chip designers into real volume customers, not just interest, not just meetings, and not just early evaluation. In the near term, Intel’s 18A node continues to be positioned as a viable path, but the longer range strategy for many outside clients appears to be centered on Intel’s 14A process as the primary goal, particularly for customers chasing higher performance class designs.

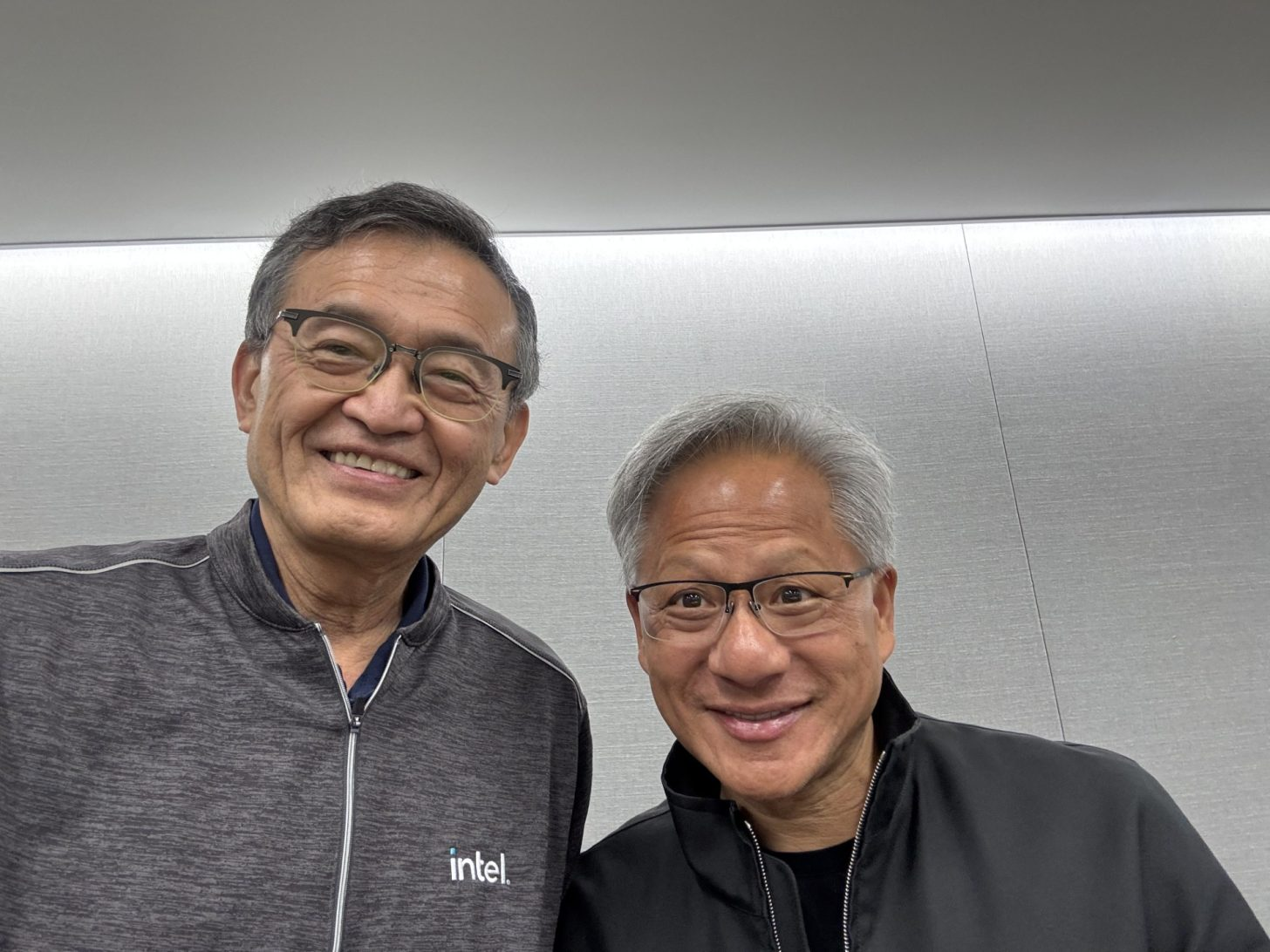

A recent report from Reuters coverage adds important context to how cautious those external evaluations still are. According to Reuters, NVIDIA tested whether it would manufacture chips using Intel’s 18A process but did not continue moving forward, with the report citing people familiar with the matter. That single detail does not automatically translate into a foundry failure, but it does underline how demanding the bar is when a top tier fabless client evaluates a new manufacturing option at this scale, especially when the project economics and product risk are measured in billions.

The more realistic lens is that this kind of testing is part of standard due diligence. PDK evaluation, sampling, and early technical validation are routine steps when a fabless company engages with a foundry. It is not a signed deal, and it is not a rejection letter either. It is a gating process, and the decision to proceed depends on yield confidence, ramp timelines, power and performance targets, packaging alignment, and whether the foundry can prove repeatable results at volume.

That is where Intel’s positioning around 18A versus 14A becomes strategically important. The 18A node has been discussed repeatedly as a node that aligns strongly with Intel’s internal roadmap and product priorities, where power efficient performance and platform integration matter heavily. External customers that need high performance compute class scaling, aggressive frequency targets, and highly optimized density curves may see 14A as the more compelling milestone to watch, because it is being framed as the node that better matches what those clients want to ship in the next major cycle.

The Reuters report also ties Intel’s foundry ambitions into a broader political and capital narrative around Intel’s role in United States industrial policy, which can influence perception and partnership dynamics for any company planning to manufacture in the United States. For gamers and PC hardware watchers, the key implication is not partisan, it is operational: if Intel can translate government support and ecosystem pressure into a credible manufacturing ramp, it expands optionality across the supply chain and adds competitive tension to the foundry landscape over time.

At the same time, Intel Foundry cannot win this conversation on messaging alone. External clients will keep waiting for proof points that matter in the real world: stable yields, predictable schedules, competitive power performance metrics, and consistent execution on advanced packaging and tooling. In that sense, 18A being an option is useful, but 14A being the primary target is the bigger narrative, because it sets expectations that the true external customer wave is still ahead, not fully here yet.

Do you think Intel Foundry’s real win condition is landing 1 flagship external client at scale, or proving consistent high volume yields first even if the early customers are smaller?