PC Shipments Could Drop in 2026 as the Memory Supercycle Squeezes Supply and Pushes Prices Higher

The memory supercycle is rapidly becoming a worst case scenario for PC gamers and builders, especially anyone trying to assemble a full system in the current market. RAM pricing has surged in recent weeks, and the knock on effect is starting to cascade through the broader component stack, where GPU vendors are also facing rising costs tied to general purpose DRAM. According to the IDC 2026 market analysis, the industry is heading into a volatile 2026 where supply constraints and higher pricing pressure could materially reshape how PCs are bought and sold.

IDC frames the timing as a perfect storm for the PC ecosystem, colliding directly with the Windows 10 end of life refresh cycle and the ongoing AI PC marketing push. This matters because the industry is attempting to drive upgrades at the same time that foundational components are becoming harder to source at stable pricing. When memory tightens, it does not just impact DIMMs on retail shelves. It impacts BOM planning, configuration decisions, channel inventory strategy, and ultimately what SKUs reach gamers at acceptable price to performance ratios.

IDC also highlights that PC vendors are signaling broad price increases as the cost environment intensifies into H2 2026. The report notes that major OEMs including Lenovo, Dell, HP, Acer, and ASUS have warned customers of tougher conditions ahead, pointing to pricing hikes in the 15% to 20% range and contract resets as part of an industry wide response. For gamers, this translates into a likely squeeze on both prebuilt pricing and the cost of key upgrade paths, with fewer value configurations surviving in the mainstream.

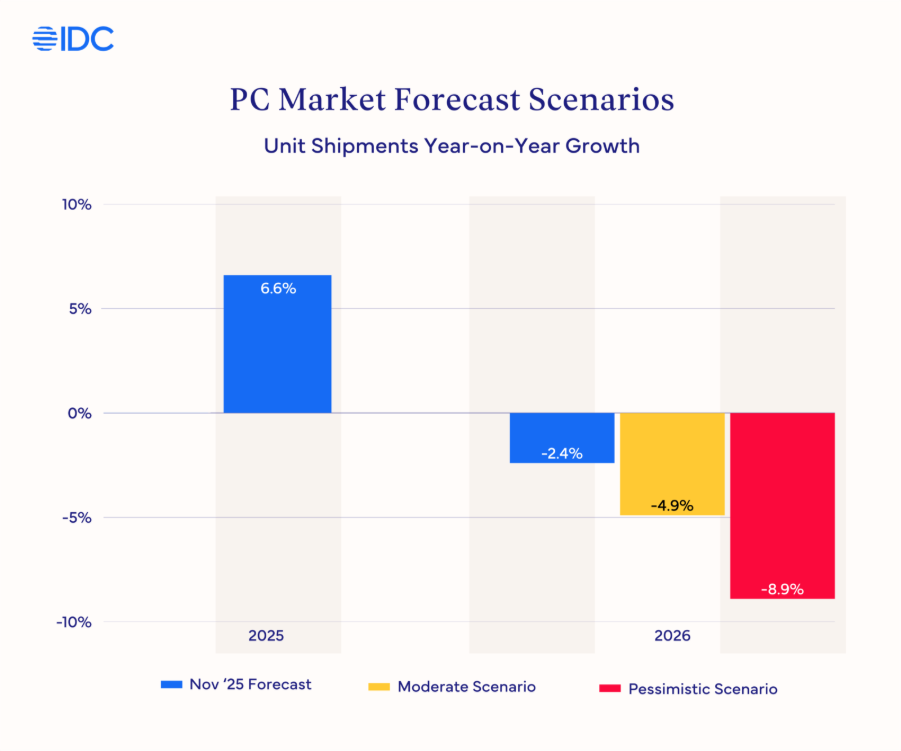

From a shipment perspective, IDC expects the PC market to decline by 4.9% in 2026, while also noting that the downside could deepen if the memory situation worsens further. That is a critical signal because it suggests pricing and availability issues may reduce demand, even as upgrade cycles try to pull consumers forward. For the enthusiast segment, it sets up a scenario where the desire to upgrade can remain high, but the cost to do so rises fast enough to push many buyers into wait and see mode.

Another key takeaway is the likely shift in market share dynamics. IDC suggests larger OEMs may gain share versus local vendors and the DIY ecosystem, largely because big manufacturers can bundle and position prebuilt systems as an attractive value proposition when individual parts become more expensive and harder to source consistently. If that plays out, 2026 could become a tougher year for custom PC builds, not because the community loses interest, but because the total platform cost and parts availability make DIY significantly less competitive versus a consolidated prebuilt purchase.

IDC also expects the AI PC narrative to slow in 2026, partly because on device AI experiences such as Copilot+ benefit from higher RAM configurations, and memory constraints can force manufacturers to scale back on more premium memory baselines. The report’s logic is simple: if higher RAM becomes structurally more expensive, mass market devices will trend toward lower standard configurations to defend pricing. That is not a great fit for AI PC positioning, and it is also not ideal for gamers who want longevity and smoother multitasking on mainstream laptops.

If the memory supercycle holds its current trajectory, the next year could become one of the most challenging periods for PC component buying in recent memory, with disruption intensity that could rival past crunch eras. For gamers, the strategic play may shift toward timing purchases around stable inventory windows, prioritizing value stable platforms, and watching OEM configuration moves closely since those decisions will define what is actually available on shelves.

What are you seeing in your local market right now: RAM price spikes, fewer 16 GB laptop configs, or higher GPU pricing pressure?