Micron Faces HBM4 Validation Headwinds, Opening a Clear Lane for Samsung to Regain Share in the Rubin and MI400 Era

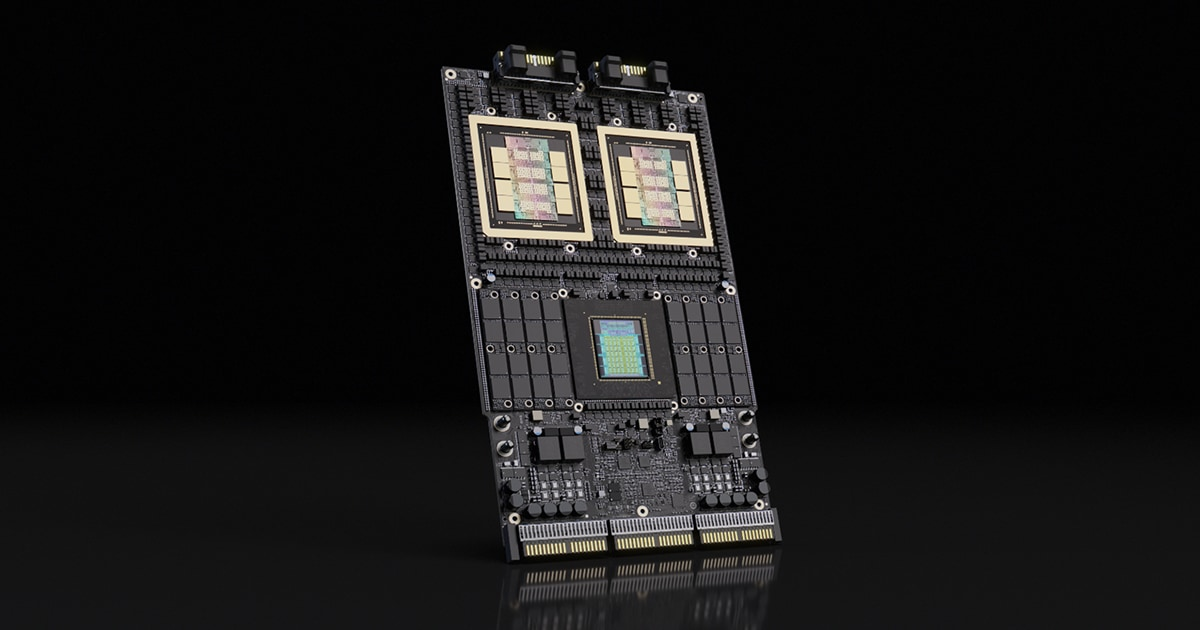

HBM4 is quickly becoming the new battleground for next generation AI accelerators, with NVIDIA’s Rubin platform and AMD’s Instinct MI400 class products pushing the memory stack deeper into the performance envelope. And while the market is still in motion, new signals suggest Micron is running into meaningful validation friction on HBM4, creating a tangible opportunity for Samsung to expand its footprint if it can execute consistently.

The latest wave of chatter started circulating through a post on X, but the more concrete datapoints arrive via a Korean industry report from Hankyung. In that report, NVIDIA is described as having already assigned provisional HBM4 volumes across its major suppliers as it prepares for Vera Rubin production, with SK hynix at roughly the mid 50 percent range, Samsung in the mid 20 percent range, and Micron around 20 percent.

SemiAnalysis: We reduce Micron’s $MU share of Nvidia Rubin HBM to zero. We currently do not see indications of Nvidia ordering Micron HBM. We expect Nvidia’s HBM4 supply to consolidate SK Hynix and Samsung at a 70/30 split.

— Wall St Engine (@wallstengine) February 6, 2026

This early split matters because HBM production is not a last minute procurement game. Hankyung notes that HBM manufacturing lead times can stretch past 6 months, which is why allocation decisions and qualification progress translate directly into who can actually ship volume when Rubin ramps.

From an industry perspective, Micron’s main risk is timing and execution. If a supplier hits validation delays, pin speed targets, thermals, or base die design hurdles, the customer does not wait. They rebalance allocation toward whoever is ready and stable, because missed shipments cascade across entire server programs.

Hankyung also points to a key market narrative: Micron is rumored to be facing difficulty with NVIDIA HBM4 delivery, which is fueling expectations that Samsung’s share could climb toward 30 percent depending on how Micron progresses through qualification and volume readiness.

That is the business reality of this cycle. HBM4 is not just about peak performance in a lab. It is about repeatable yields, predictable packaging throughput, and the ability to clear customer validation milestones on schedule.

Samsung’s situation is especially interesting because it has something the market can sell. Hankyung reports that Samsung is expected to begin mass production and shipments of HBM4 to NVIDIA this month, and it highlights Samsung HBM4 performance figures at 11.7Gbps, with Samsung described as having been first to pass quality testing.

Yet the same report also explains why Samsung still trails SK hynix on share: production capacity, yield maturity, and the broader economics of where Samsung chooses to allocate wafer and packaging resources. In plain terms, Samsung can prove it has world class HBM4, but it still has to scale it profitably and reliably at the volumes Rubin class platforms demand.

If Micron cannot land HBM4 in volume on the customer timeline, the most realistic outcome is a larger share tilt toward SK hynix, with Samsung expanding as the secondary winner. That aligns with Hankyung’s current market view that SK hynix remains the stable backbone supplier for NVIDIA, while Samsung has the opening to take incremental share if it can keep clearing milestones and scaling output.

For gamers and PC buyers watching this from the outside, it is another reminder that AI platform ramps can reshape memory supply priorities across the entire industry. When HBM becomes the headline, the downstream effects often show up in pricing and availability for everything else.

Do you think Micron can realistically recover HBM4 momentum within 2026, or will this generation become a 2 supplier race where Samsung and SK hynix split most of the upside?