Intel PowerVia and BSPDN Strengthen the 18A Value Proposition, But External Customer Volume Still Looks Like a Later Win

Intel Foundry has been fighting an uphill battle for external customer commitments for years, but momentum around the 18A process is starting to look more credible thanks to real product integration and a clearer technology narrative. With 18A now tied to Panther Lake progress and the platform story improving, industry attention is shifting from whether Intel can execute internally to whether it can attract meaningful external volume. Right now, the answer appears to be not yet, and the friction point sits in a core architectural shift: BSPDN.

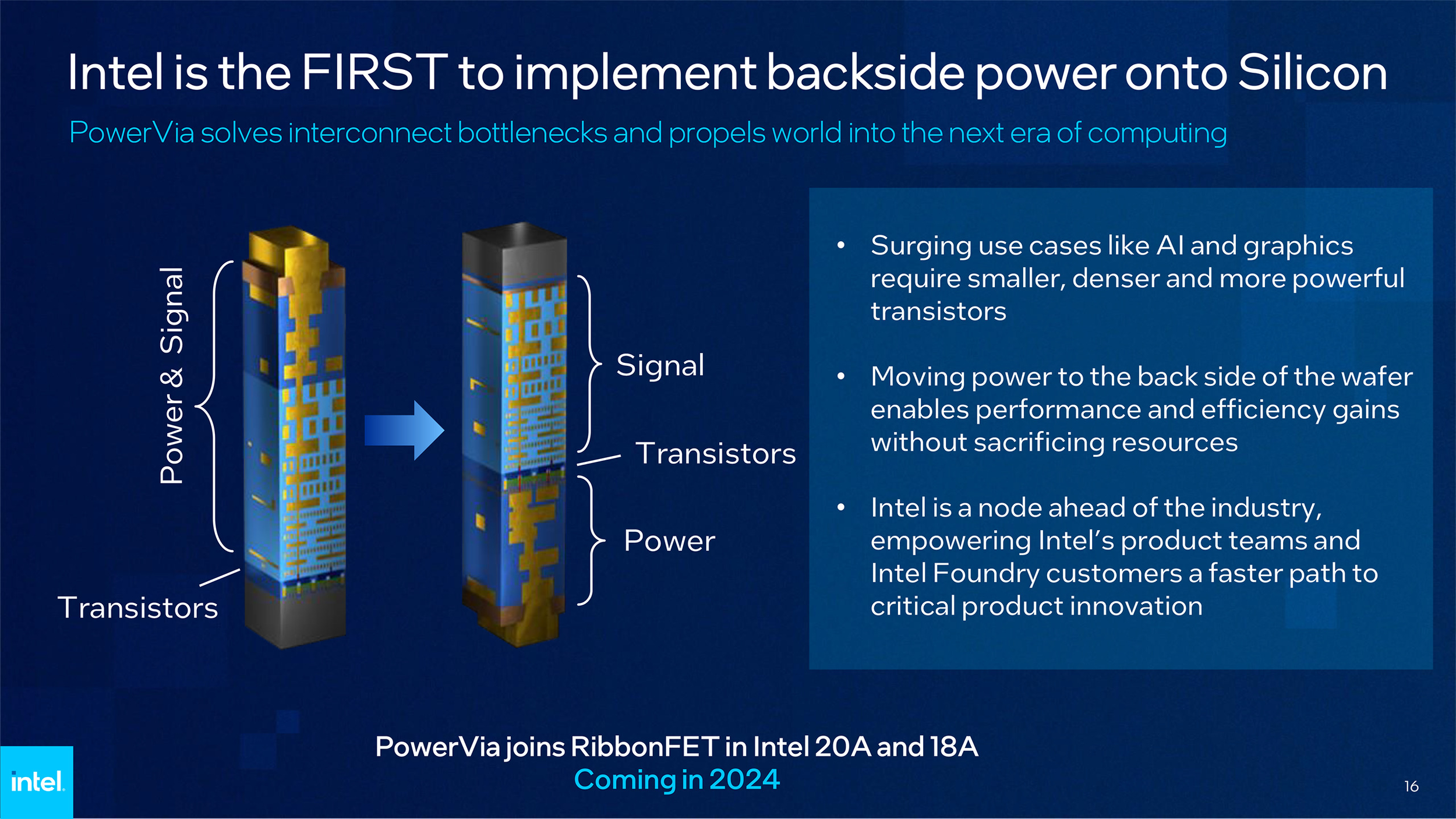

BSPDN stands for Backside Power Delivery Network, and it is central to Intel’s PowerVia approach on 18A. The promise is straightforward: route power and ground from the back side of the wafer so the front side has more freedom for signal routing. In theory, that creates a cleaner signal environment, better power integrity, and a more scalable path as designs get denser and performance targets climb. In practice, it asks customers to rethink how they build chips.

That is where the adoption barrier comes in. Backside power is not just a feature toggle. It can require a ground up rework of physical design methods and flows because it deviates from the norms many teams have optimized for over multiple generations of frontside power delivery. This is not simply a tooling update. It is process methodology change, and methodology change is expensive, slow, and risk heavy for external customers with product schedules and validation gates that punish uncertainty.

TechInsights highlights this dynamic in its commentary on 18A, arguing that backside power is a bet Intel is placing earlier than the rest of the foundry field, with long term benefits but real short term portability costs. TechInsights also notes that competing foundries are expected to delay similar backside implementations until later, with broader adoption anticipated around 2027.

Intel’s challenge is compounded by the fact that 18A bundles multiple major shifts at once. PowerVia and RibbonFET being introduced together raises the ceiling on potential efficiency and scaling, but it also raises the bar for customer confidence. For an external design team, each additional variable adds integration risk. The result is a predictable near term outcome: interest and evaluation today, but cautious volume commitments until the ecosystem matures.

Still, Intel does gain a positioning advantage by being early with PowerVia. If Intel can prove repeatable yields, predictable PPA outcomes, and stable design enablement across real products, it can turn that early bet into a meaningful competitive moat, especially as rivals move toward similar backside power concepts later. The stronger Panther Lake execution becomes, the more Intel can market 18A as a validated platform rather than a theoretical leap.

This is also where a derivative like 18A P could become the bridge. If Intel can package lessons learned into a more customer friendly variant with clearer enablement and smoother migration expectations, adoption could accelerate without forcing every partner to absorb the full shock of first generation change. Even so, it is reasonable to expect that Intel may find broader external traction when the market is already psychologically prepared for new power delivery norms, potentially closer to the 14A era, when backside power and next generation transistor transitions may be viewed as baseline expectations rather than optional risks.

The strategic takeaway is that PowerVia improves Intel’s future negotiating leverage, but it does not instantly translate into external volume. Intel is building a long runway advantage, and the next milestone is not just technical success. It is design flow trust, repeatability, and a customer proof point that makes BSPDN feel like an upgrade instead of a reinvention.

If you were a chip designer, would you commit to Intel 18A early to gain the PowerVia advantage, or wait for broader industry readiness closer to 2027 and beyond?