RAM Prices Are Flattening Out This Week, But the Real Pressure Point Is Still Ahead

A quick glance at retail RAM pricing suggests the market is finally taking a breath. Over the past few days, DDR4 and DDR5 pricing curves have started to flatten, and on the surface that can look like the memory shortage narrative is losing steam. But this is not a victory lap moment. In practice, the flattening is more consistent with short term inventory behavior than a genuine recovery in supply conditions.

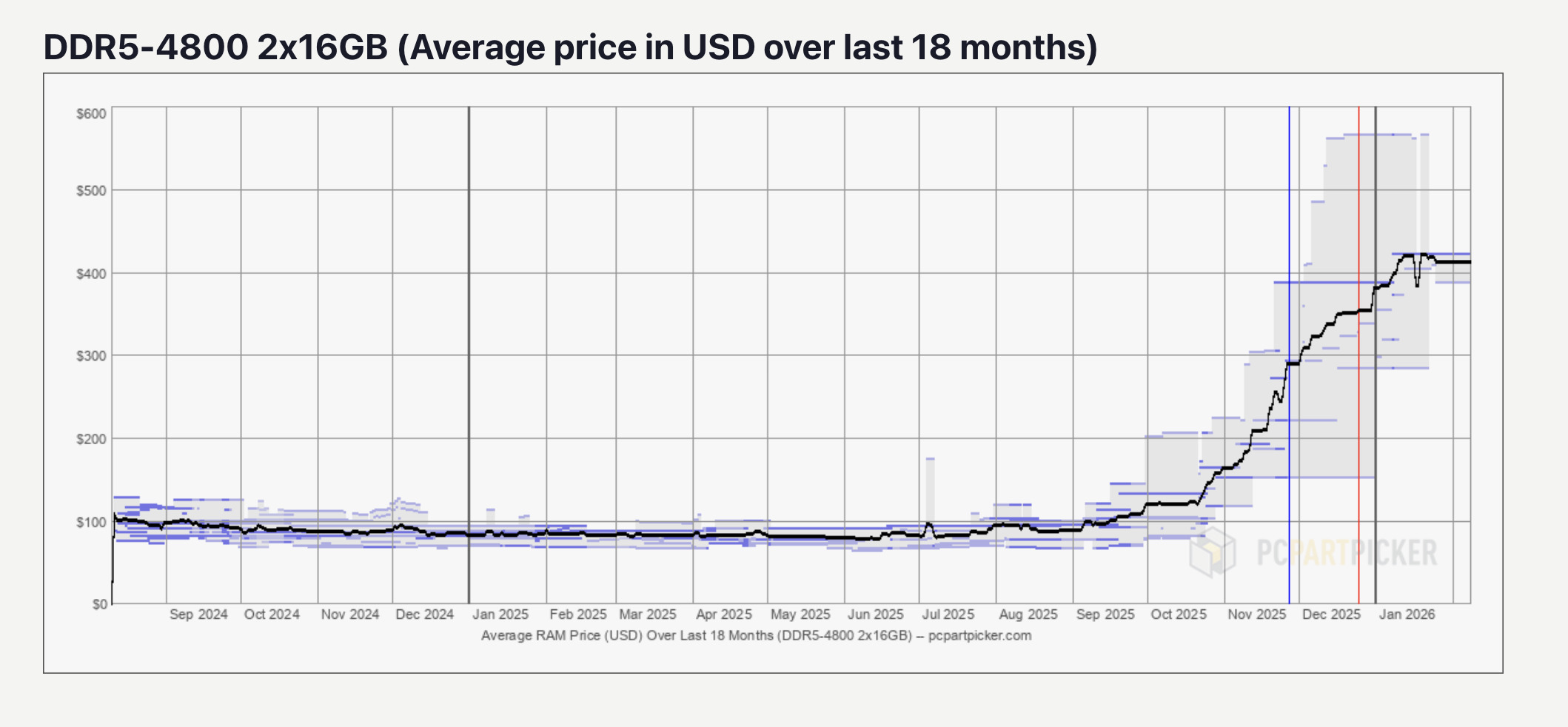

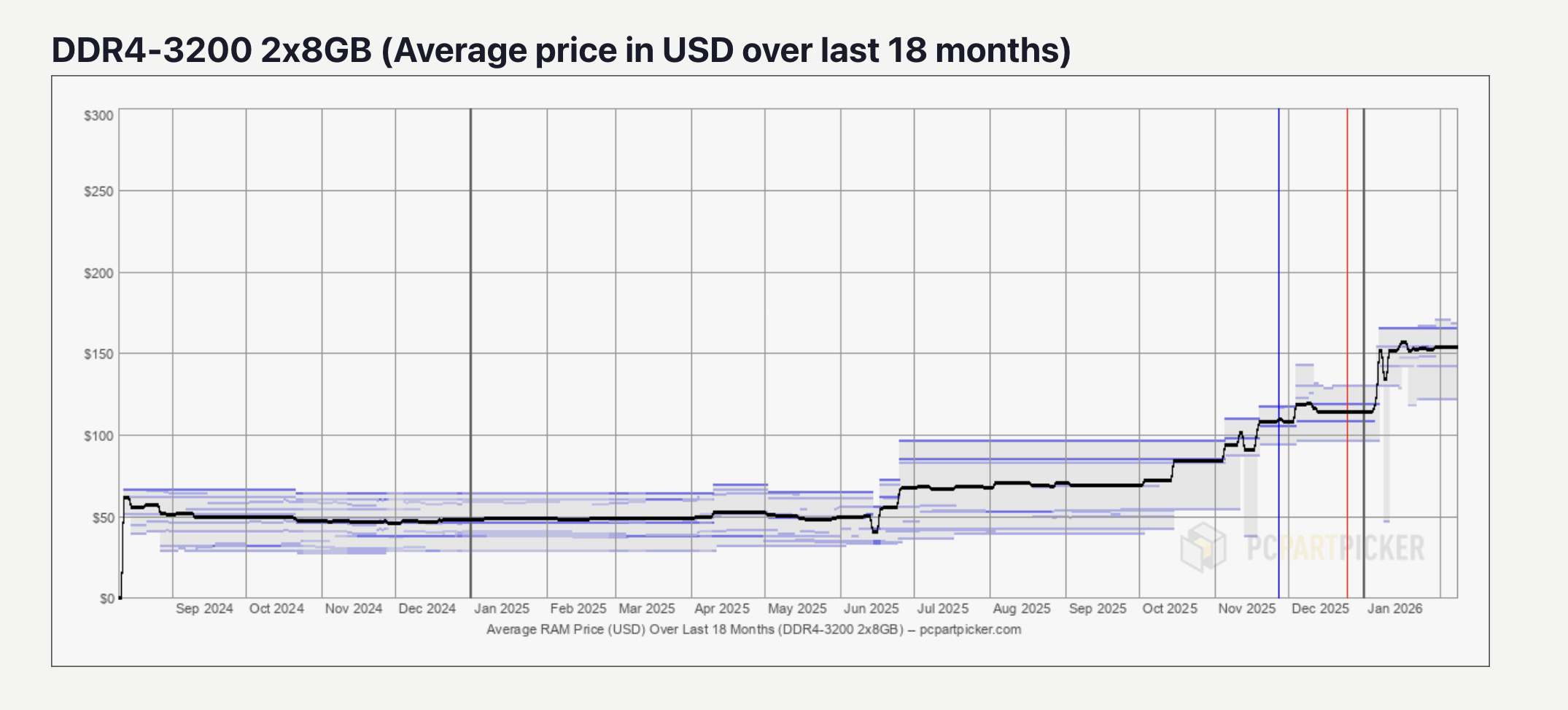

Tracking data from PCPartPicker shows both DDR4 and DDR5 trending into a more stable band recently, but stability does not automatically mean affordability is coming back. The more realistic read is that the channel is cycling inventory and protecting cash flow, not that supply has normalized. When distributors and resellers want liquidity, the easiest lever is to offload existing stock more aggressively, even if the broader pricing trend remains upward.

That interpretation lines up with commentary shared by analyst Jukan Choi, who cited reporting that the stabilization is being driven by inventory turnover and cash flow needs heading into Lunar New Year. Choi’s post points to more distributors clearing inventory at lower prices to improve cash circulation, creating modest pullbacks from peak levels rather than a true reversal of the cycle.

The key issue is what happens after this short cooldown. The market is still shaped by contract dynamics, not just what shows up on a consumer tracking chart. If contract DRAM pricing continues to rise aggressively, it creates a delayed but powerful downstream effect on general purpose memory products. Even if spot conditions temporarily soften due to inventory clearing, suppliers still have the leverage to reassert pricing through new agreements, especially while AI infrastructure demand continues to absorb capacity and keep suppliers focused on maximizing profitability.

So yes, the retail trend line looks calmer for the moment, but it is calm for operational reasons, not optimistic ones. If you are a gamer or PC builder planning a 2026 upgrade, the smarter mindset is to treat this as a temporary window of reduced volatility, not the end of the shortage. The hard part is not the chart flattening. The hard part is what suppliers and contract pricing do next.

If you are building a new PC in 2026, would you buy memory now during this brief flattening, or wait and risk the next pricing wave?