Intel and SoftBank SAIMEMORY Team Up on Z Angle Memory as Team Blue Eyes a Return to Next Generation DRAM Innovation

Intel is signaling a serious intent to re enter the memory conversation, not by shipping commodity DRAM, but by positioning itself alongside SoftBank Corp subsidiary SAIMEMORY in a new next generation memory initiative called Z Angle Memory, also referred to as ZAM. The collaboration is explicitly framed as an AI era play, where training and inference workloads keep pushing data movement into the spotlight, and where high capacity, high bandwidth, and lower power consumption are now table stakes for modern data centers.

According to SoftBank, SAIMEMORY signed a collaborative agreement with Intel on 2026 02 02 to advance commercialization of ZAM, with a stated target to build prototypes in the fiscal year ending 2028 03 31, and to pursue commercialization in fiscal year 2029. This is not positioned as a vague research partnership. It is positioned as a roadmap driven program aimed at getting a new memory architecture into real world infrastructure planning windows that hyperscalers and AI platform vendors can actually align around.

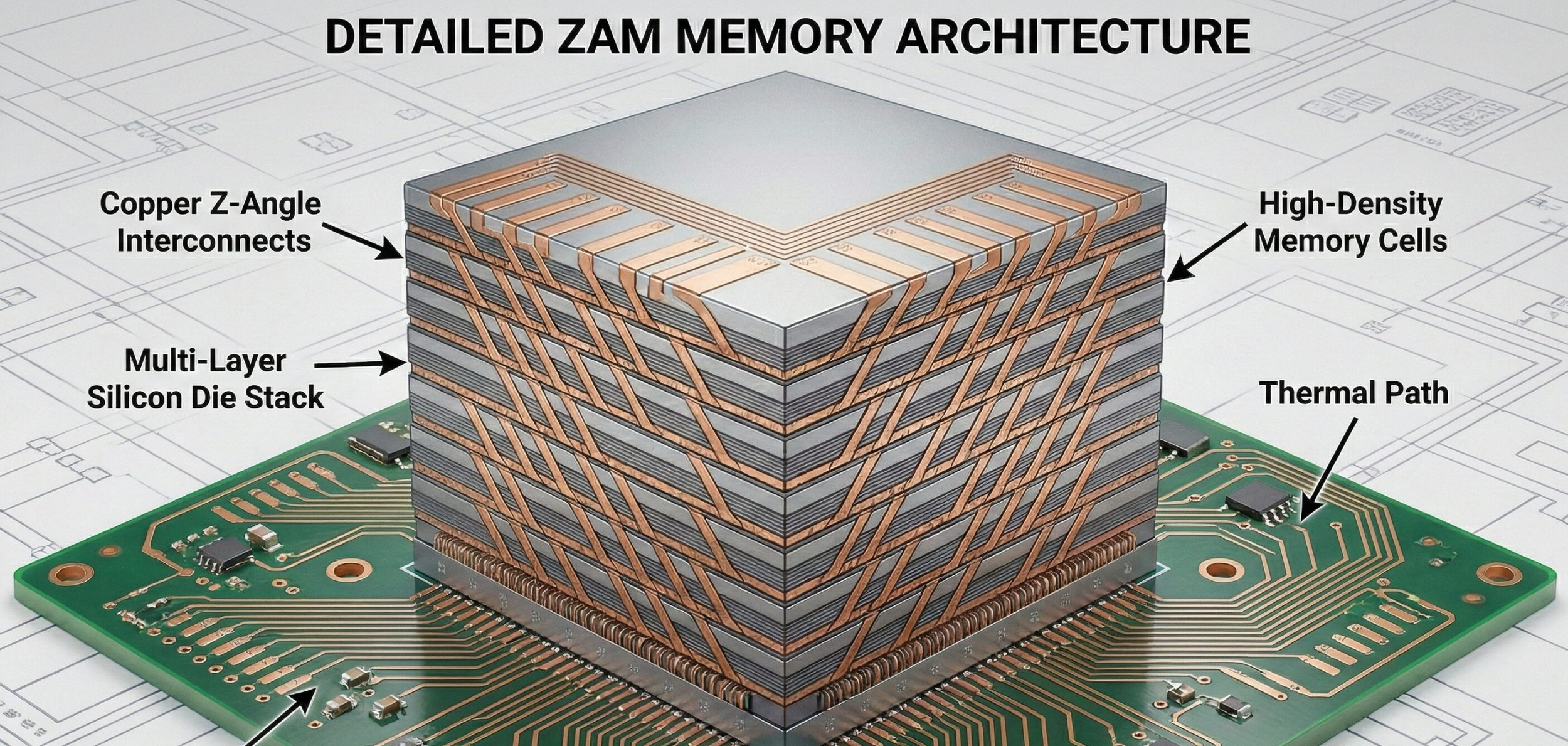

The technical backbone, at least as described by SoftBank, ties directly to Intel’s Next Generation DRAM Bonding initiative, abbreviated as NGDB, which Intel completed under the Advanced Memory Technology program supported by the United States Department of Energy and National Nuclear Security Administration through Sandia National Laboratory, Lawrence Livermore National Laboratory, and Los Alamos National Laboratory. SoftBank says SAIMEMORY will leverage the foundational technologies and expertise validated through that NGDB effort as it works on innovative memory architectures and manufacturing technologies for ZAM.

So what is ZAM meant to be in practical terms. SoftBank’s framing is straightforward and infrastructure focused: use ZAM to enable high capacity and high bandwidth data processing with enhanced processing performance and reduced power consumption in environments that run large scale AI model training and inference. That language is important because it places ZAM as a potential alternative or complement to current high end memory approaches used around accelerators, where power and thermals increasingly define how far system designers can push density and throughput before they hit physical limits.

From an industry strategy lens, this partnership also lands at a moment when the market is already on edge about supply constraints and pricing pressure across the memory stack. In that context, Intel aligning itself with a new standard style initiative is a very deliberate move. It creates optionality for ecosystem players that are tired of living in a seller controlled memory market, while giving Intel a path to participate in memory value without needing to fight the pure volume DRAM war that it exited decades ago.

For gamers and PC enthusiasts watching from the sidelines, this is not an immediate consumer story, but it is absolutely a downstream impact story. AI infrastructure demand is already reshaping where memory capacity goes first, and when data center procurement absorbs the lion’s share of advanced memory supply, the ripple effects typically show up later in workstation pricing, premium PC component availability, and the broader cost structure of high performance computing hardware. If ZAM becomes commercially viable on the timeline SAIMEMORY is targeting, it could eventually become one of the pressure release valves that helps the industry scale without simply brute forcing power draw and cost upward forever.

If Z Angle Memory delivers real power savings and bandwidth gains at scale, do you see it as a genuine HBM challenger, or a niche option that only a few AI platforms will adopt?