TSMC Signals The AI Demand Wave Is Still Accelerating, With CapEx Guidance Set To Hit Record Highs

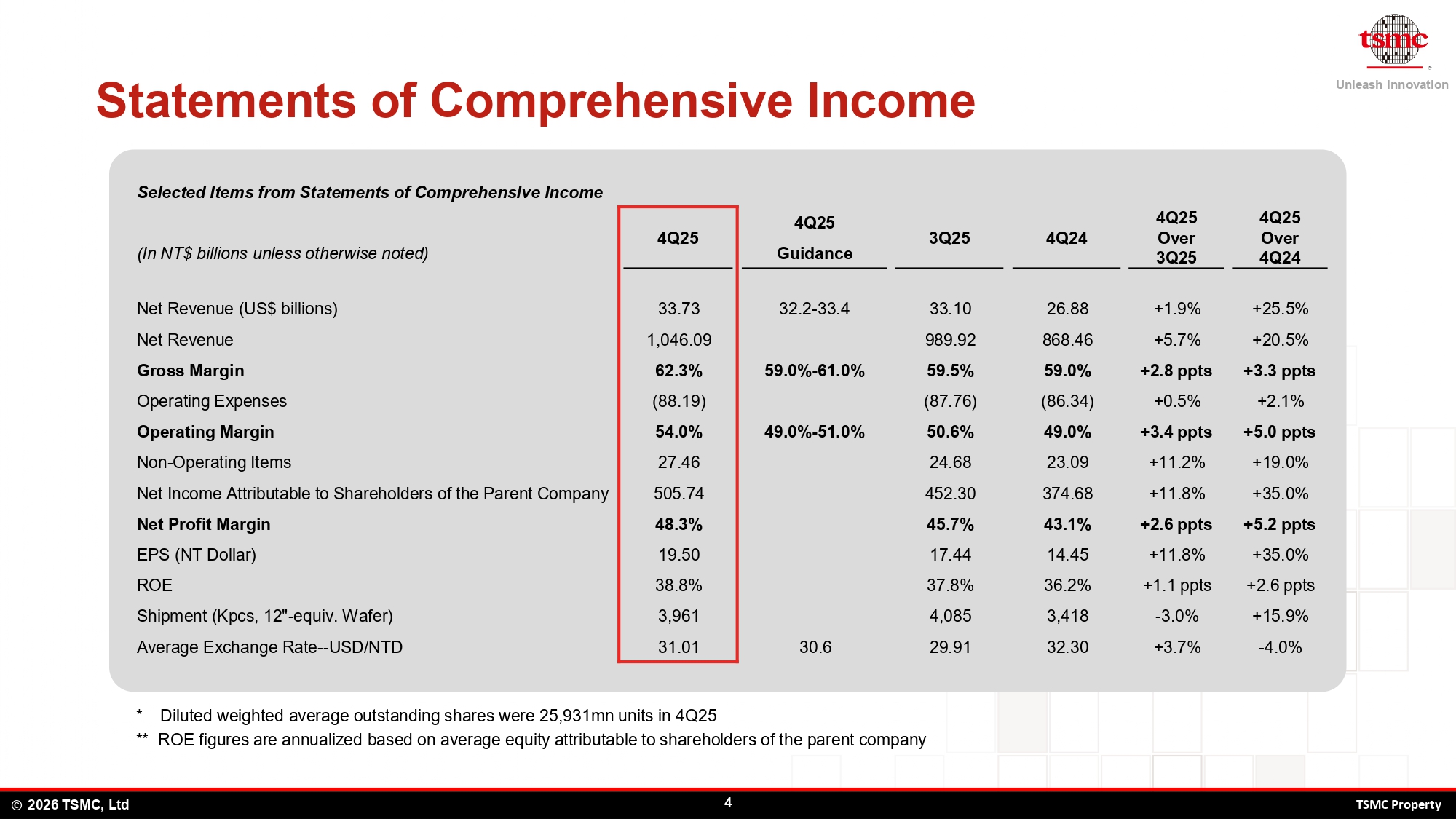

TSMC’s latest financial update is sending a clear message to the semiconductor supply chain: the AI buildout is not cooling off, and the company believes it needs to scale at a pace that is effectively unprecedented for its own historically disciplined playbook. In its Q4 2025 earnings report, TSMC framed high performance computing demand as the dominant growth engine, with management commentary suggesting that AI related orders are not only durable, but still intensifying as hyperscalers and leading chip designers continue expanding infrastructure footprints.

A key signal in the quarter is how directly TSMC is tying platform mix to its forward investment posture. The revenue by platform breakdown highlights HPC as the primary driver, reinforcing the market reality that advanced nodes and advanced packaging are now tightly coupled to AI accelerators, high end networking, and data center buildout cycles. TSMC is effectively acknowledging that the next phase of growth is constrained less by demand and more by the ability to add validated capacity fast enough.

That is why the headline number here is CapEx. TSMC indicated it plans to invest between 52B$ and 56B$ across its operations, spanning wafer fabrication expansion, advanced packaging, testing, masks, and supporting infrastructure. The increase is described as a 31% year over year jump and about 17% above consensus expectations, underscoring how aggressively the company intends to widen the supply funnel even at the risk of near term cost pressure. For an organization that has built its reputation on execution discipline, this level of spending is a strategic statement that AI demand is being treated as structurally real, not cyclical hype.

TSMC Chairman and CEO C.C. Wei also addressed the internal mindset shift behind the spending ramp. He indicated that he was initially cautious about how sustainable AI demand would be, but changed his view after direct engagement with hyperscalers and major customers, including reviewing their financial posture. The takeaway conveyed in the earnings discussion is that these customers are financially strong and appear positioned to keep investing, which in turn gives TSMC more confidence that expanding capacity will not result in strandedC style overbuild risk.

Another major dimension of the CapEx strategy is geographic expansion, especially the United States. TSMC stated that a large portion of its spending will support its US operations, including preparations tied to 2nm production lines in Arizona. The company also referenced Fab 2 coming online as early as the 2nd half of 2027, which is a meaningful timeline marker for customers planning multi year product roadmaps. Perhaps more importantly, Wei noted that production yields in Taiwan relative to those in the US are very close, implying that the execution gap is narrowing and that supply chain maturity in the US is improving through sustained investment and operational learning.

Taken together, the read through is simple: TSMC expects AI related demand to remain hot through 2026, supply to stay constrained, and customer allocations to remain booked out well in advance. The company is responding with a CapEx posture that prioritizes capacity, packaging, and throughput expansion rather than optimizing for short term margin comfort. In the AI era, the competitive edge increasingly comes from who can ship at scale, with consistent yields, across both leading edge nodes and advanced packaging, and TSMC is investing as if that race will define the decade.

What do you think is the bigger bottleneck for the AI supply chain in 2026, leading edge wafer capacity, advanced packaging capacity, or the ability to scale power and networking in data centers?