Samsung Foundry Gains Momentum as a Secondary United States Option, Deutsche Bank Note Highlights Edge Over Intel Foundry

As the AI buildout keeps tightening leading edge wafer capacity, the foundry conversation is shifting from who is number 1 to who becomes the most credible second source when schedules, geopolitics, and allocation risk collide. A Deutsche Bank note shared via Jukan argues Samsung Foundry is currently leading that secondary foundry race, with Samsung’s Taylor, Texas site positioned as a key destination for customers looking beyond TSMC, while Intel Foundry continues to face execution challenges.

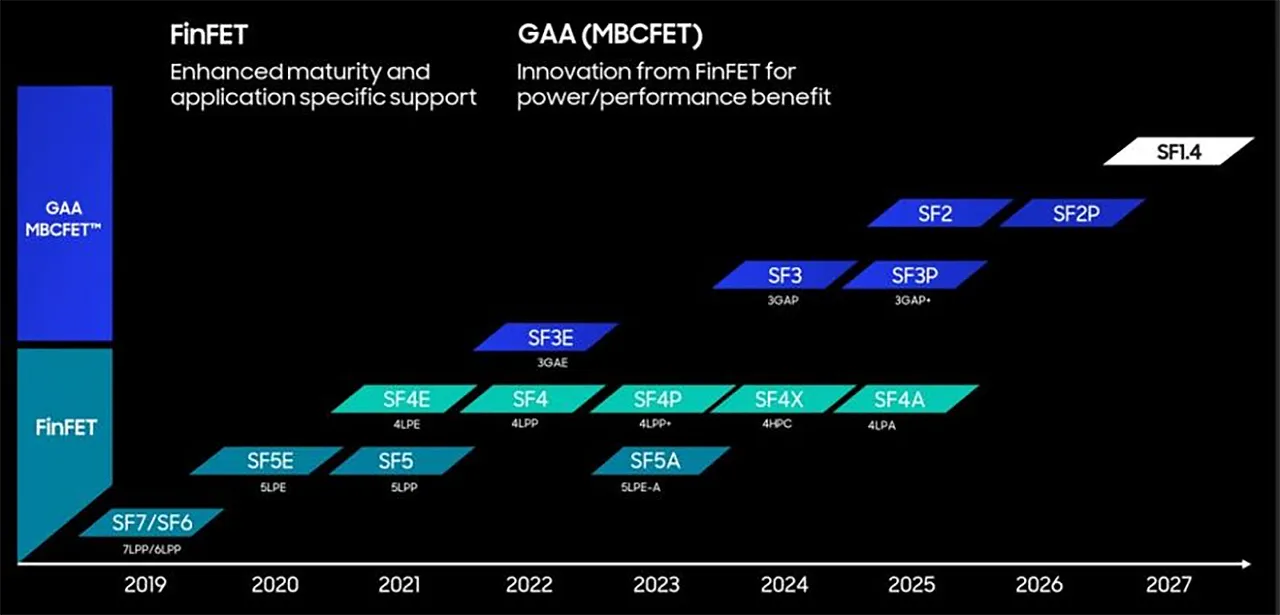

The claim is not just about branding, it is about how quickly customers can believe a platform is real. According to the report referenced in the note, fabless players such as Qualcomm and AMD are exploring foundry orders with Samsung, likely centered on the company’s 2 nm class process SF2 and related derivatives. The strategic implication is that Samsung is selling a smoother risk profile because it has already demonstrated it can land major commitments for its foundry business, which helps reduce buyer anxiety when compared to a foundry still proving its customer ramp at the most advanced nodes.

Taylor becomes the focal point in this narrative because it aligns with what many chip designers want right now: more leading edge manufacturing located in the United States, plus a packaging roadmap that can support modern AI silicon requirements. Industry reporting has repeatedly pointed to Samsung adjusting Taylor plans toward a 2 nm start and building out advanced packaging capability, which is the kind of end to end readiness customers want when they are balancing performance, yield, and supply chain resilience.

This is also where Samsung’s prior customer momentum matters. The Deutsche Bank angle suggests that confidence is higher because Samsung already has credibility with major technology buyers in adjacent manufacturing relationships, which can translate into trust when those buyers evaluate second source options. In contrast, Intel Foundry is still in the phase where it must convert roadmap strength into repeatable production execution and external customer wins at scale, especially for 18A class manufacturing and the broader packaging stack needed for advanced AI products.

Still, it is important to keep the operational reality grounded. Interest and negotiation do not equal wafers in volume. Both Samsung and Intel need the same next milestone: turning exploratory discussions into real production line commitments with clear delivery windows, verified yields, and platform level predictability. Until that happens, the dual source narrative remains a strategic signal, not a confirmed reshaping of the foundry hierarchy.

If the thesis holds, the near term winner is not just Samsung or Intel, it is any fabless company that successfully de risks supply by creating a credible second source while keeping performance and cost targets intact. The next few quarters should reveal whether Samsung’s Taylor focus and SF2 positioning can translate into tangible orders, and whether Intel’s 18A push can counter the perception gap with customer facing execution.

Do you think dual sourcing will become the default for AI era chips, or will most customers still bet on 1 primary foundry and treat the second source as insurance only?