RAM Shortages Are So Extreme Thieves Are Now Pulling Memory Modules Out Of PCs Instead Of Taking The Whole System

The DRAM market crunch is starting to spill out of pricing charts and into real world security headaches. In a recent incident shared on a Korean public forum, a thief reportedly broke into an office environment and chose a surprisingly specific target: the memory itself. Rather than attempting to move an entire desktop tower, the thief allegedly smashed the tempered glass side panel and removed the RAM modules, a decision that reflects how distorted value density has become during the current shortage cycle.

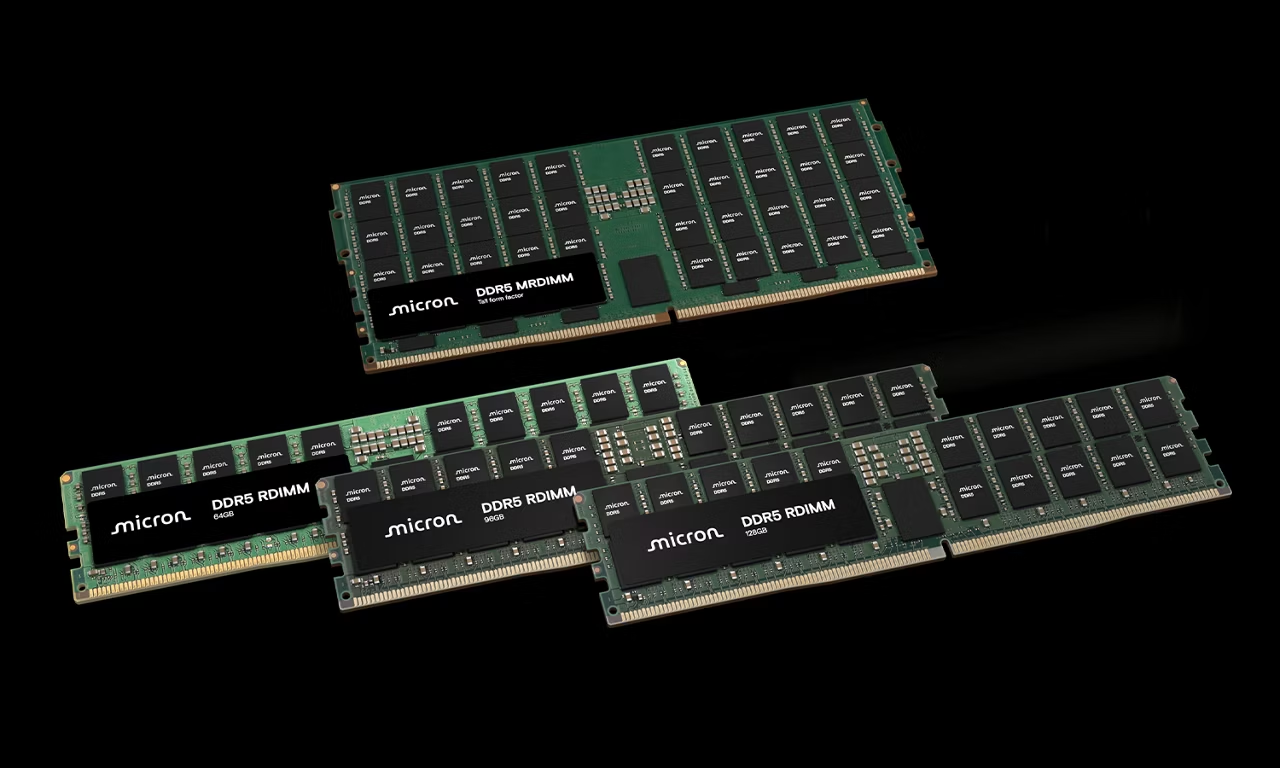

According to the account posted on the Korean forum post, the thief stole a total of 4 Micron memory modules at 32GB each, leaving the rest of the PC behind. In normal market conditions this would sound irrational, but in an environment where high capacity modules can command extreme markups, it becomes a fast, low friction theft play: less weight, less bulk, lower chance of being noticed, and easier resale liquidity compared to moving a full system.

RAM thiefhttps://t.co/3toIOGhlb9 pic.twitter.com/1sa22bjSBK

— 포시포시 (@harukaze5719) January 14, 2026

The post also highlights a secondary problem that is quietly becoming a pain point for businesses: insurance compensation friction. The user claims their company has a liability contract for the affected equipment, yet reimbursement is proving difficult because the current market pricing of memory is volatile and inflated. When replacement cost swings aggressively, claims adjusters can struggle to match real world retail pricing, especially if a module’s street price has effectively disconnected from historical baselines. The result is a gap between what was lost and what can realistically be compensated under typical policy structures, turning a simple parts claim into a negotiation.

This incident also reflects why consumer and small business markets tend to feel DRAM shocks more sharply than many other categories. Memory is relatively easy to remove, easy to sell, and easy to validate, which makes it a prime target whenever pricing spikes. A whole PC requires transportation, storage, and more risk in the physical chain. A handful of modules can fit in a pocket and convert quickly into cash. When shortages intensify, the threat model changes, and PC hardware stops being just a performance decision and starts becoming an asset protection concern.

From an industry perspective, the key takeaway is not just that shortages drive higher prices, but that they also shift behavior across the ecosystem. Businesses may need to rethink physical security for workstations and lab machines, and insurers may need to update valuation playbooks for components whose pricing can swing faster than standard depreciation tables can handle. For gamers and enthusiasts, it is also a reminder that transparent side panels and easy access tool free cases are great for building, but they are not great for theft resistance when component resale value gets out of control.

This report is shared for awareness and market context, not as a how to. If anything, it underlines how urgently supply stability and pricing normalization matter, because the downstream effects are no longer limited to checkout totals.

What practical steps do you think PC owners and small offices should take right now to protect high value components without turning every setup into a locked server room?