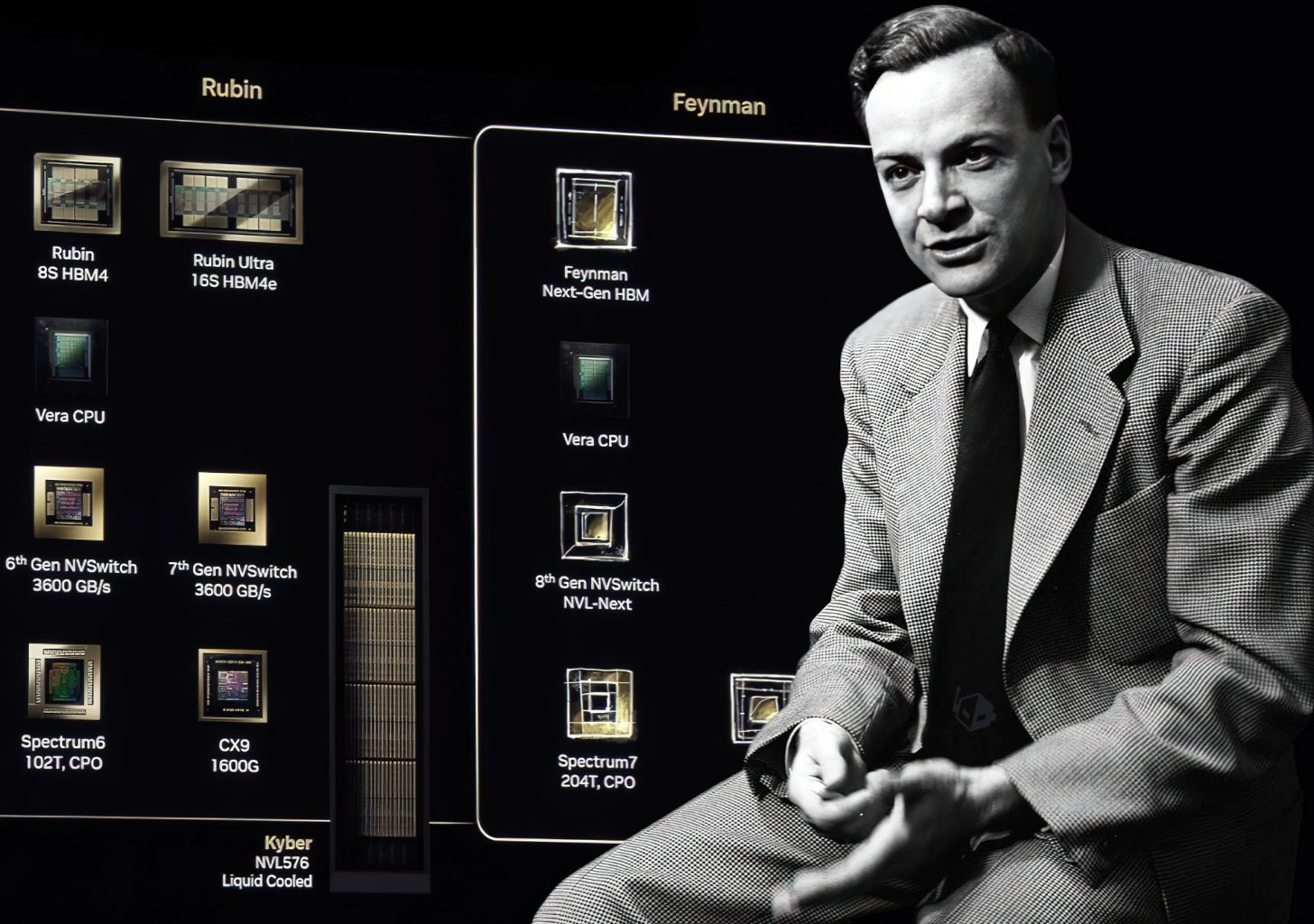

NVIDIA Reportedly Eyes Intel Foundry 18A or 14A and EMIB for Feynman AI Chips in a Strategic Shift Beyond TSMC

NVIDIA is reportedly taking concrete steps toward a dual foundry future, as the AI boom keeps turning leading edge wafer capacity into a global choke point. According to a new report from DigiTimes, Team Green is evaluating Intel Foundry for parts of its next generation Feynman AI platform, specifically exploring Intel 18A or Intel 14A for the Feynman I O die alongside Intel EMIB advanced packaging.

The key takeaway is the structure of the reported plan. NVIDIA is not said to be moving an entire flagship GPU compute stack over to Intel. Instead, the report frames this as a low risk partnership that would outsource only the Feynman I O die to Intel Foundry, while keeping the remaining production with TSMC. In other words, this is NVIDIA hedging without destabilizing its core performance and volume ramp, because the I O die is typically less risky to multi source than the most bleeding edge compute tiles that drive the majority of performance per watt headlines.

The report also claims NVIDIA could allocate 25% of total Feynman production volume to Intel, with the rest staying at TSMC. If accurate, that split signals two priorities at once. First, NVIDIA wants a meaningful second supply lane, not a symbolic pilot run. Second, NVIDIA still wants to keep the majority of output on the industry’s most proven high volume AI foundry path, minimizing execution risk during an era where hyperscalers and enterprises are effectively ordering capacity years in advance.

Intel Foundry’s momentum is a big part of why this is even on the table. Intel 18A has been positioned as a critical inflection point for the company’s foundry credibility, and 14A is being framed as the forward looking option for customers who want a longer runway. If NVIDIA is genuinely evaluating either node for an I O die, that alone helps validate Intel’s external customer narrative, particularly when paired with EMIB, which is one of Intel’s most established packaging differentiators for multi die integration.

The strategic logic here is bigger than node marketing. Several major fabless companies are being pushed toward dual foundry strategies because the current AI buildout depends heavily on TSMC for both front end fabrication and back end packaging capacity. That creates 2 structural vulnerabilities: extreme capacity competition during peak demand cycles, and single point of failure exposure if geopolitics disrupt supply. The report argues these pressures are escalating, which is why alternative foundries, primarily Intel and Samsung, are increasingly relevant to companies that used to treat TSMC as the default answer.

For NVIDIA specifically, the reported low risk approach also hints at a broader playbook: start with a non core die where yield variability is less existential, validate the manufacturing and packaging flow, then scale the relationship if Intel executes. The most interesting forward looking implication from the report is the suggestion that NVIDIA could eventually outsource additional non core products to Intel Foundry. If that expands beyond AI into gaming adjacent silicon over time, it would mark a meaningful shift in how the PC ecosystem thinks about supply assurance for future GeForce generations.

Right now, this remains a report, not a confirmed partnership announcement. Still, the direction is clear: the AI era is forcing the biggest chip designers to build resilience into their manufacturing plans, and Intel Foundry is pushing hard to be more than a backup option.

What do you think is the bigger story here, NVIDIA reducing risk by diversifying beyond TSMC, or Intel Foundry gaining legitimacy if a high profile customer like NVIDIA actually puts real volume on 18A or 14A?