Newzoo Forecasts Global Games Market to Reach $197 Billion as 2025 Surpasses Expectations

Global games market intelligence firm Newzoo has released its year in review report covering January to November 2025, outlining a stronger than expected performance for the global video games industry. According to the 2025 year in review report, the market is now projected to reach $197 billion once full year figures are finalized, representing a 7.5 percent increase compared to 2024. This growth trajectory positions the industry just shy of the $200 billion milestone, with momentum suggesting it could surpass that threshold as early as next year.

The report arrives shortly after recent data from Circana highlighted November 2025 as one of the weakest months for US physical game and hardware sales in three decades. In contrast, Newzoo’s global outlook underscores continued consumer resilience, particularly across PC and mobile platforms. While macroeconomic pressures such as tariffs, rising living costs, and emerging memory shortages may exert more influence in 2026, Newzoo indicates that 2025 closed on a notably positive note.

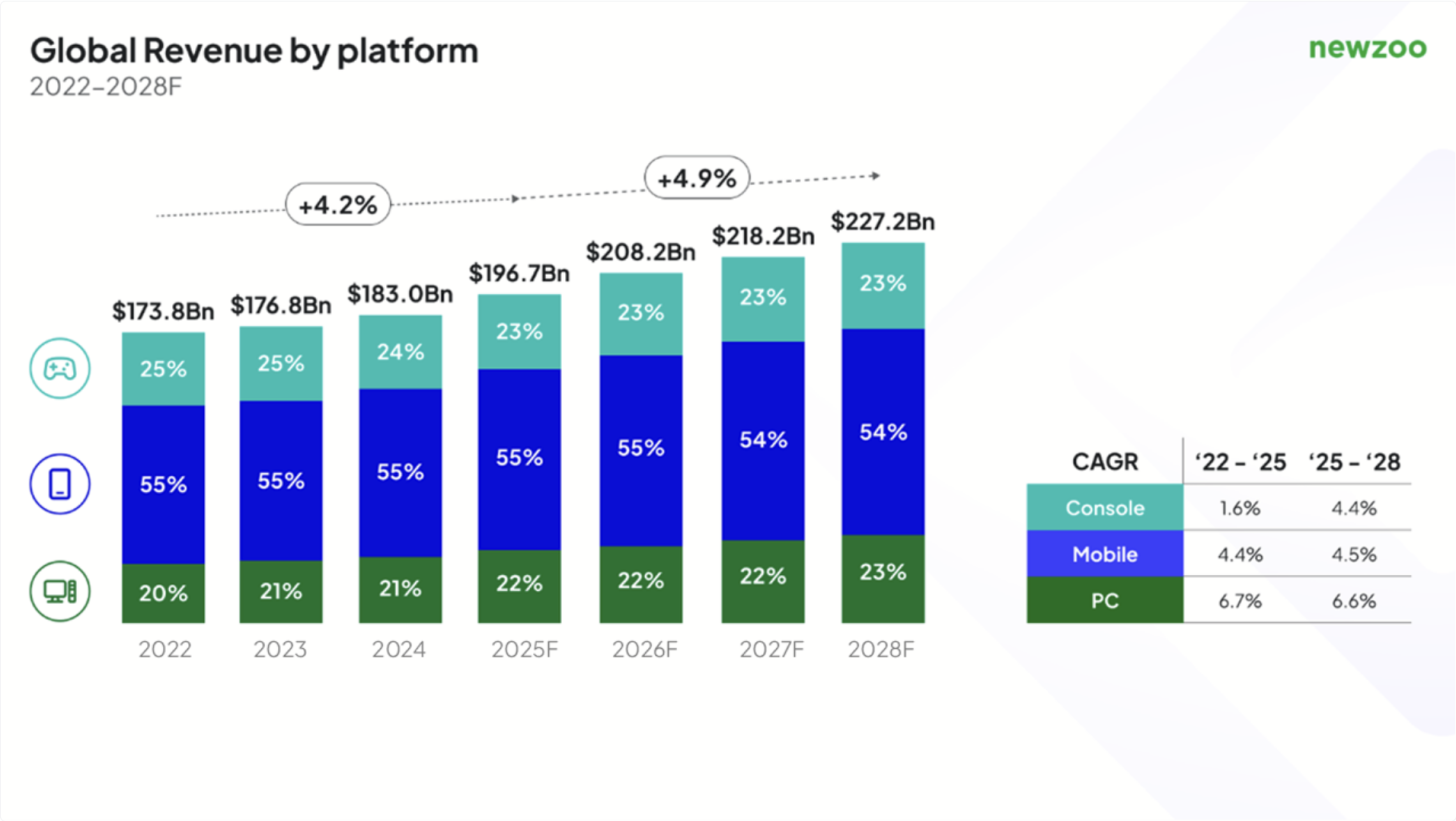

Breaking down the numbers, mobile gaming remains the largest revenue contributor, expected to reach $108 billion, reflecting a 7.7 percent year on year increase. Console gaming is projected to generate $45 billion, up 4.2 percent, while PC gaming shows the strongest growth rate at 10.4 percent, climbing to $43 billion. Newzoo notes that PC and mobile growth significantly exceeded internal forecasts, serving as the primary drivers pushing the industry toward its near $200 billion valuation.

While mobile gaming continues to benefit from long running titles from publishers such as Tencent and Century Games, PC growth presents a more nuanced and strategically important narrative. According to Newzoo, PC revenue expansion is being fueled less by player base growth and more by deeper engagement and spending within established ecosystems. Principal market analyst Michiel Buijsman explains that “the 2025 outcome reflects players spending more deeply within games and ecosystems they already value, rather than growth being driven by a sudden expansion of the player base.”

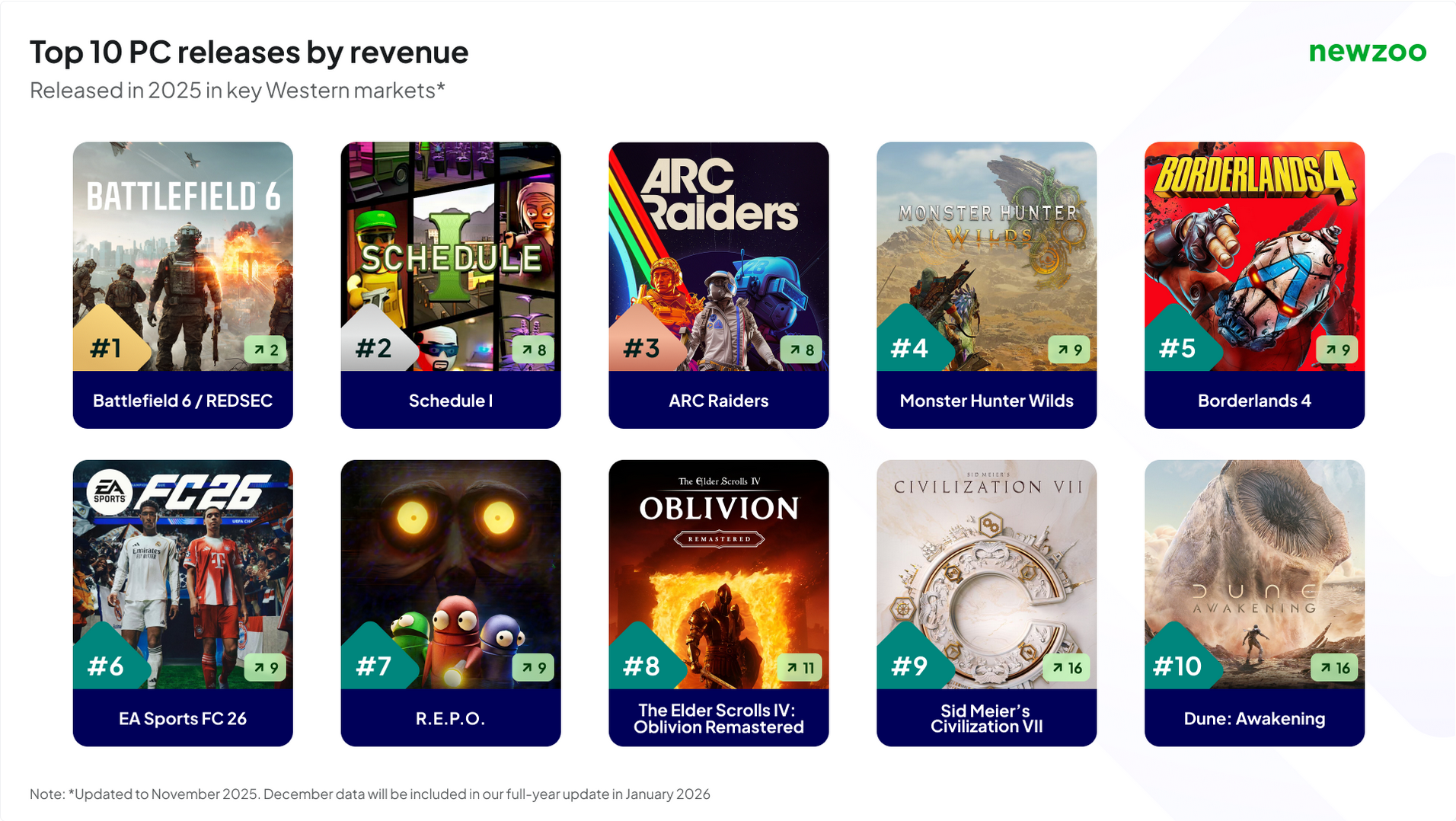

This trend is clearly reflected in Newzoo’s top ten PC games by revenue for 2025. All ten titles were released within the year, none are free to play, two are indie games, and three are entirely new intellectual properties not based on existing franchises. Newzoo describes this as evidence of PC’s openness to experimentation, varied experiences, and system driven design, reinforcing its role as the industry’s innovation backbone even as console titles dominate mainstream visibility.

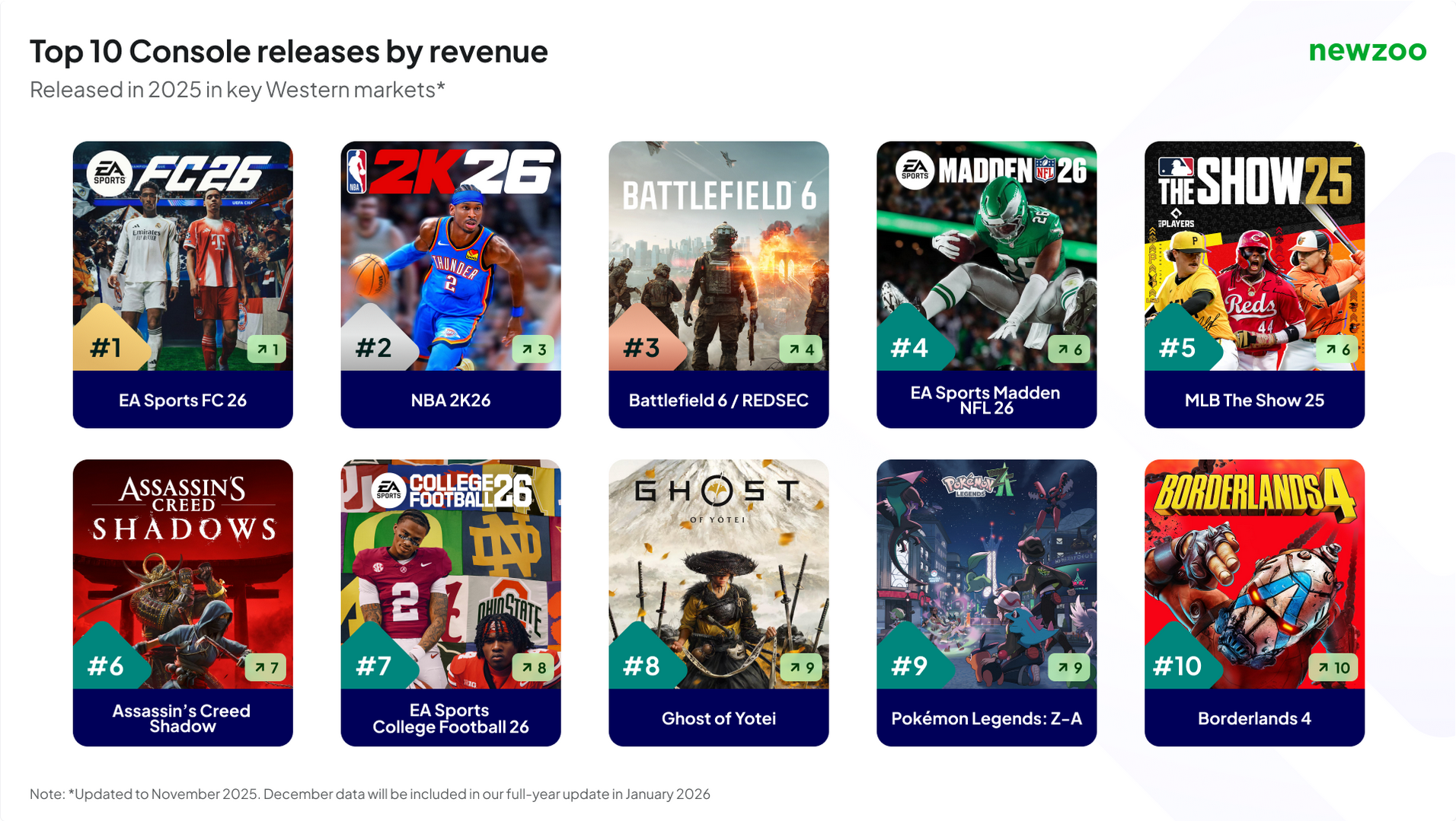

On the console side, revenue rankings tell a more traditional story. The top ten console games by revenue were also all released in 2025, but every title belongs to a major franchise, with no indie representation and roughly half consisting of annualized releases. EA emerged as the most dominant publisher, accounting for nearly half of the list. Notably, Pokémon Legends Z A secured a top ten position despite being available on only a single platform, highlighting the continued power of established IP.

Engagement metrics, measured by monthly active users, further reinforce franchise dominance. On PC, only one title in the top ten by MAUs is not based on a pre existing franchise, while the console MAU top ten is composed entirely of long running series. Interestingly, Call of Duty Black Ops 7 appears in the console MAU top ten but nowhere else in the report’s top rankings. In contrast, Battlefield 6 achieved top ten placement across both revenue and MAU lists on PC and console, marking a decisive performance edge for the franchise in 2025.

Newzoo’s report also emphasizes the growing influence of indie games on industry discourse. Titles such as Clair Obscur Expedition 33 played a significant role throughout the year, culminating in a historic showing at The Game Awards where it claimed Game of the Year alongside a record number of additional awards. Indie success stories are increasingly shaping player expectations and publisher strategies alike.

Looking ahead to 2026, Newzoo highlights major structural shifts underway across the industry. High profile moves such as EA’s decision to privatize and Ubisoft’s launch of Vantage Studios point to increasing ownership concentration and tighter portfolio management. Newzoo director of market intelligence Manu Rosier notes that “a smaller number of companies now control a larger share of the industry’s most influential IP, while platforms increasingly shape which games are funded, distributed, and scaled.”

As 2025 closes with stronger than anticipated results, Newzoo’s data suggests that the global games industry remains on a stable growth path, driven by engagement depth, platform diversification, and a renewed appetite for both established franchises and bold new ideas.

Do you think PC driven growth and indie success will continue to define the industry in 2026, or will consoles and mobile regain momentum next year?