NAND Makers Reportedly Cut Output to Push SSD Prices Higher as DRAM Margins Steal the Spotlight

A new report from Chosun Biz says Samsung and SK hynix are planning to cut NAND production forecasts, with the core rationale being simple profitability math. In the current AI boom, DRAM is throwing off stronger returns, and because NAND and DRAM share parts of the same upstream supply chain and manufacturing prioritization decisions, vendors have every incentive to divert resources toward the segment that prints better margins.

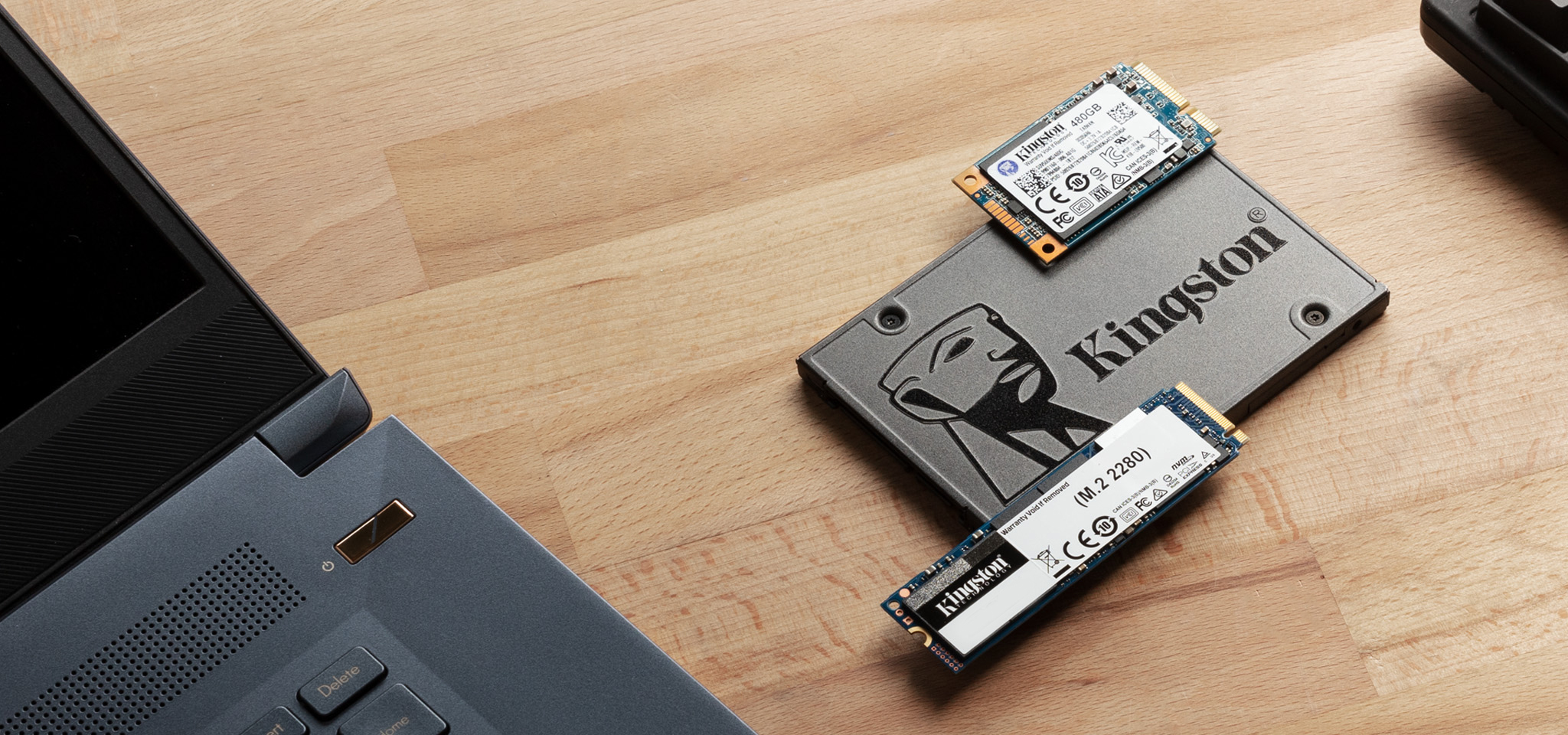

The consumer impact is where this gets real, fast. When large suppliers deliberately tighten NAND output, the downstream effect usually shows up as firmer contract pricing, higher spot pricing, and less aggressive retail discounting on SSDs. In plain gamer terms, this is how the market turns a normal upgrade cycle into a wait or pay moment, especially for higher capacity drives that PC players lean on for modern installs, shader caches, and growing live service libraries.

What makes the timing more disruptive is that NAND is no longer just a phone and PC storage story. It is becoming infrastructure for AI systems at massive scale. NVIDIA has been publicly describing its Inference Context Memory Storage approach as part of the platform direction for next generation AI factories, positioning storage as a way to extend and reuse context while keeping systems efficient. As demand rises from AI racks that lock in supply quarters ahead, consumer buyers become the flexible segment that absorbs the shock through pricing.

That is the key strategic dynamic to watch. AI hyperscalers and major platform buyers tend to secure supply earlier and for longer, while DIY builders, gamers, and mainstream OEM laptops often live closer to retail pricing swings. If Samsung and SK hynix do reduce NAND output meaningfully, the market may see a familiar pattern: enterprise demand stays protected, while consumers get the shortage narrative and the higher checkout total.

For gamers and creators planning builds in 2026, the practical takeaway is not panic buying. It is timing discipline. If you have a storage expansion planned for a new GPU cycle, a Windows reinstall, or a big Steam library migration, the window to buy comfortably priced NAND could narrow if supply tightening accelerates and retailers stop competing as aggressively on promos.

If NAND prices keep climbing, do you pivot to smaller SSDs plus bulk HDD storage, or do you stay all SSD and just pay the premium?