U.S. Chip Industry Reaches Major Milestone as GlobalWafers Begins Domestic Silicon Wafer Production Backed by Apple & TSMC

The United States has taken another major step toward semiconductor self-reliance, as GlobalWafers confirmed it will begin producing silicon wafers domestically in Texas, supported by investments from Apple and TSMC.

A Strategic Expansion for U.S. Semiconductor Supply Chains

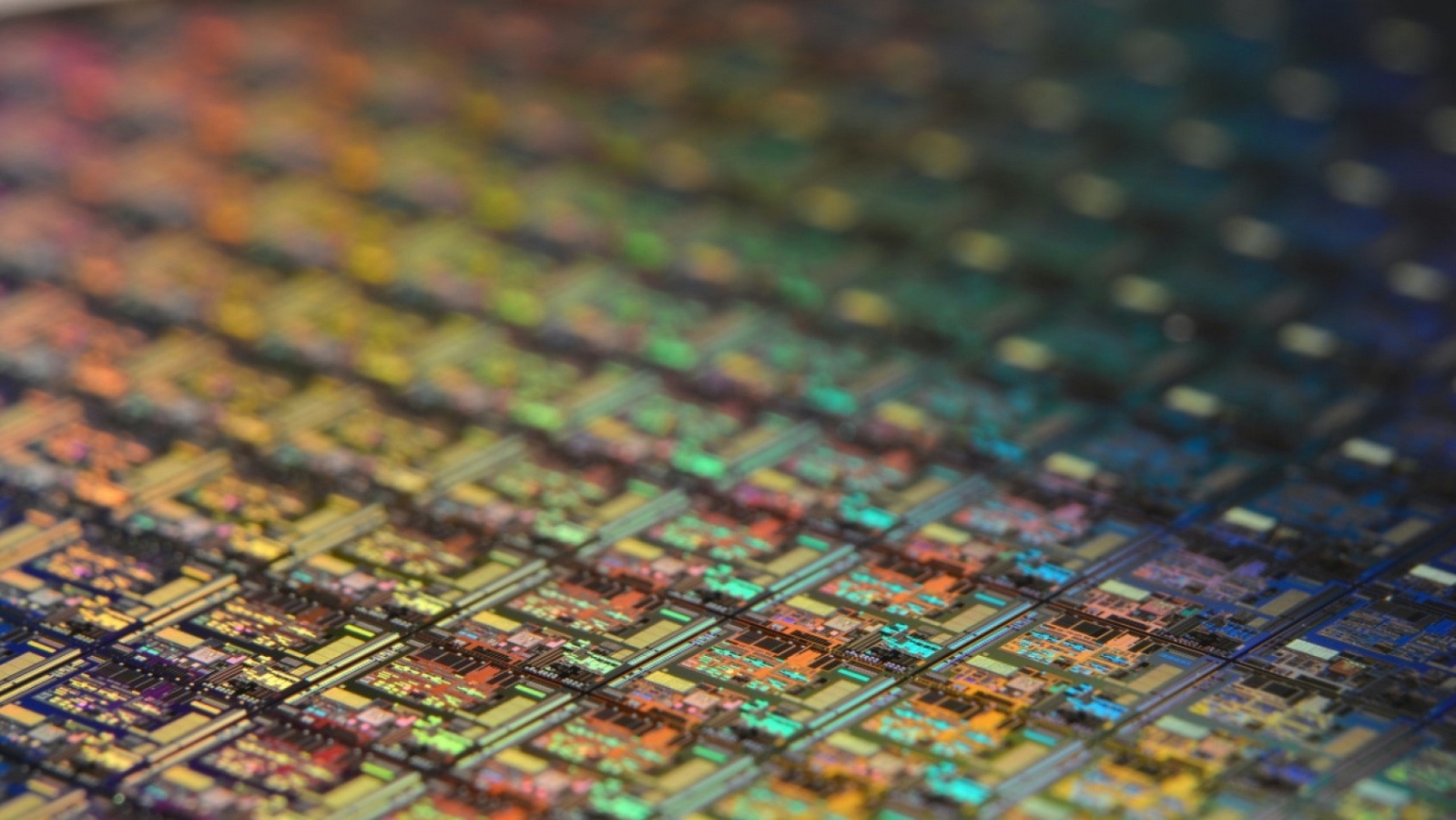

As reported by Taiwan Economic Daily, GlobalWafers’ Texas facility will mark the first large-scale domestic production of silicon wafers—a critical component in chipmaking. Silicon wafers, typically at a 300mm (12-inch) diameter for advanced semiconductors, serve as the foundation upon which companies like TSMC, Intel, and Samsung manufacture processors and other integrated circuits.

The facility’s first phase will have a projected monthly capacity of 300,000 wafers, dramatically reducing U.S. dependence on imports from suppliers such as Japan’s Shin-Etsu Chemical and Sumco. By eliminating the logistical delays of shipping wafers internationally, domestic chip production lines will gain speed, efficiency, and added resilience.

Mark England, an executive at GlobalWafers, explained that Texas was chosen for its favorable tax environment, robust supply chain, and strategic location within the U.S. semiconductor ecosystem. The facility will directly benefit TSMC’s Arizona fabs, as well as other leading U.S. chip producers, by providing a reliable local source of wafers.

A Westward Pivot in Semiconductor Manufacturing

The U.S. government’s push to strengthen domestic semiconductor production—framed as a matter of national security—has led to significant foreign direct investment. Under both the Trump and Biden administrations, incentives have drawn in heavyweights like TSMC and Samsung, who are building major fabrication facilities stateside.

Now, with GlobalWafers joining the effort, the entire chip production pipeline—from wafer creation to advanced chip manufacturing—is steadily shifting westward. This move not only enhances America’s supply chain security but also marks a turning point in the global semiconductor industry, potentially reducing reliance on East Asian suppliers in the long term.

The Texas facility signals a broader realignment, with the U.S. transforming into a hub for end-to-end semiconductor manufacturing. While it will take time for the plant to scale to its full potential, this milestone reinforces America’s position in the global race for chip sovereignty.

Do you think the U.S. can achieve full semiconductor independence in the next decade, or will Asia remain the dominant force in chip manufacturing?