TSMC 2nm Capacity Reportedly Fully Booked Through 2026 as GAA Demand Surges

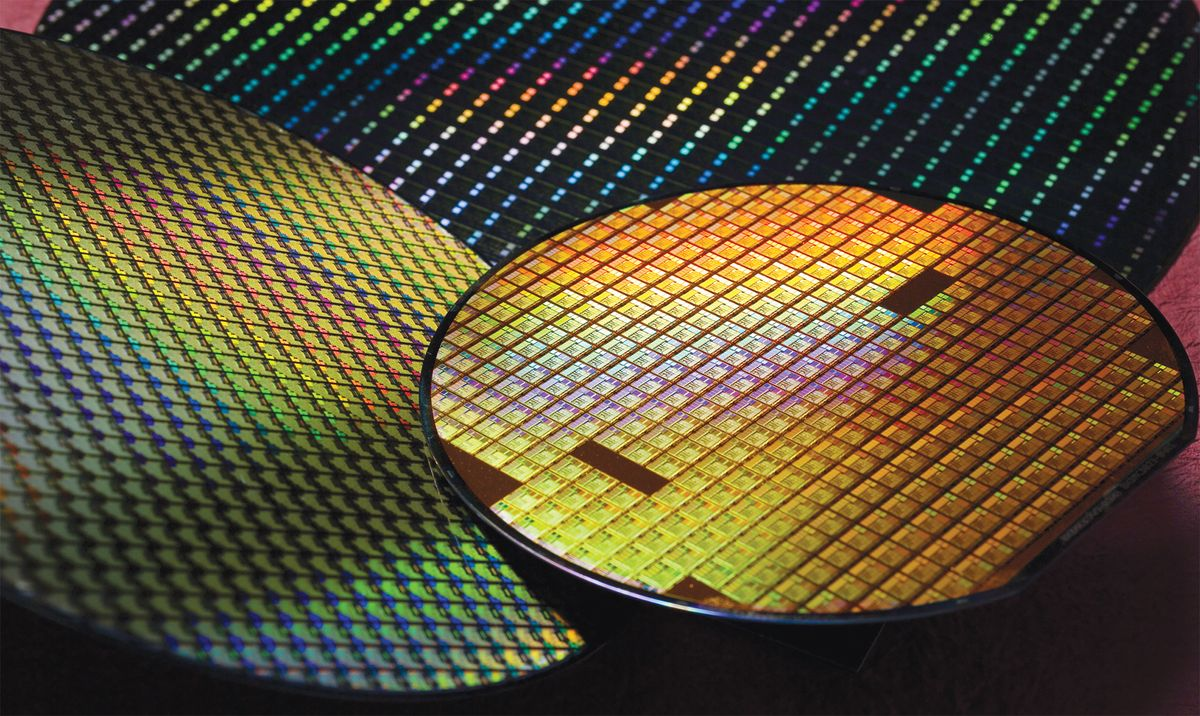

The transition into the 2nm semiconductor era is accelerating rapidly, and Taiwan Semiconductor Manufacturing Company is once again at the center of the industry’s most aggressive node adoption cycle. According to a report from United Daily News, TSMC’s entire 2nm manufacturing capacity for 2026 is already fully booked, underscoring unprecedented demand for next generation process technology well ahead of mass production.

The 2nm node is expected to formally enter large scale adoption next year, with flagship chipsets such as Apple’s A20 and A20 Pro widely anticipated to spearhead deployment. Unlike TSMC’s 3nm process, which continued to rely on FinFET transistor structures and faced certain scalability limitations, the 2nm node marks TSMC’s full transition to Gate All Around architecture. This architectural shift is a critical inflection point for performance, power efficiency, and leakage control, and it has clearly resonated with major customers across the ecosystem.

By moving from FinFET to GAA, TSMC’s 2nm process leverages nanosheet stacking to improve gate control and reduce current leakage at the transistor level. As a result, the node is expected to deliver approximately 10 to 15 percent higher performance at the same power level, or alternatively a 25 to 30 percent reduction in power consumption at equivalent performance. These gains make 2nm especially attractive for mobile, client, and high performance computing workloads where efficiency scaling is becoming increasingly difficult.

Earlier reports indicated that two of TSMC’s planned 2nm fabrication plants were already fully allocated, forcing the company to move forward with the construction of three additional production facilities. That expansion alone is estimated to require an investment of roughly $28.6 billion. The latest information now suggests that even with this aggressive build out, all available 2nm capacity for 2026 has already been reserved, with volume mass production expected to begin toward the end of that year.

A broad range of industry heavyweights are known to be lining up for TSMC’s 2nm process, including Apple, AMD, Qualcomm, MediaTek, and others. However, one key factor contributing to the capacity crunch is Apple’s reported strategy of securing more than half of the initial 2nm output. By locking in a dominant share of early production, the iPhone maker is believed to be positioning itself to maintain a clear technological lead over competitors during the first wave of 2nm devices.

To support this demand, TSMC is reportedly planning to scale its 2nm wafer output to approximately 100,000 units per month by the end of 2026. If achieved, this would make 2nm a major growth engine for the company and a cornerstone of its medium term revenue strategy.

The competitive landscape adds further context. Samsung has already announced that it began mass production of its own 2nm GAA process earlier this year. However, publicly disclosed performance, efficiency, and die area improvements have so far appeared modest when compared to its earlier 3nm GAA node. Industry observers have suggested that early yield challenges may be limiting Samsung’s initial gains, with improvements expected as the process matures.

Despite Samsung’s earlier start, TSMC appears to be taking a more conservative approach, prioritizing yield stability and manufacturing quality over being first to market. That strategy aligns with the company’s historical playbook and its reputation among customers for reliable high volume production at advanced nodes.

Looking ahead, the financial commitment required to sustain this pace of innovation is immense. Forecasts indicate that TSMC’s capital expenditure in 2026 could reach between $48 billion and $50 billion, setting a new company record. This level of spending highlights both the technical challenges of GAA scaling and the strategic importance of maintaining leadership as process nodes become increasingly complex and costly.

With 2nm capacity already spoken for through 2026, the semiconductor industry is once again facing a familiar reality. Leading edge manufacturing is becoming scarcer, more capital intensive, and increasingly dominated by a small number of hyperscale customers. For chip designers and device makers alike, access to TSMC’s most advanced nodes may prove to be one of the defining competitive factors of the next product cycle.

Do you think Apple’s aggressive capacity reservation strategy will widen the gap at 2nm, or will rivals find ways to counter despite limited early access? Share your thoughts below.