Samsung Reportedly Eyes 100% NAND Contract Price Hike in Q1 2026, With Customers Already Notified

The AI boom is no longer just a headline driver for GPUs and accelerators, it is actively reshaping the cost structure behind everyday PC parts. After months of DRAM volatility and tight GPU availability, the next pressure point may be NAND, and the potential scale is hard to ignore.

According to a report from ETNews, Samsung is said to have raised NAND contract prices by more than 100% in Q1 2026 following major long term agreements with top customers including Apple, NVIDIA, and AMD. If accurate, this is not a minor quarterly adjustment, it is a step change that could cascade straight into the consumer SSD market, where pricing already feels unstable at retail.

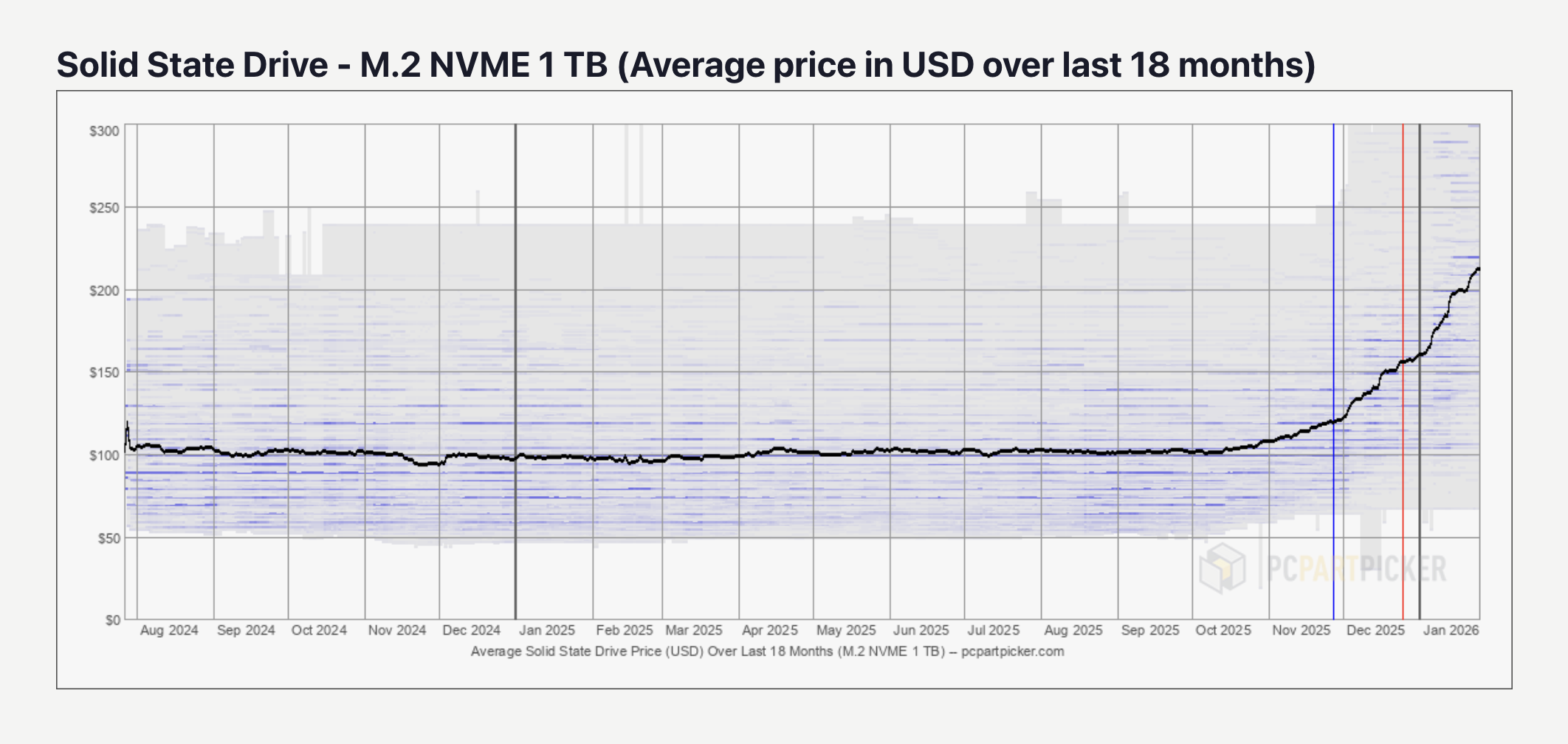

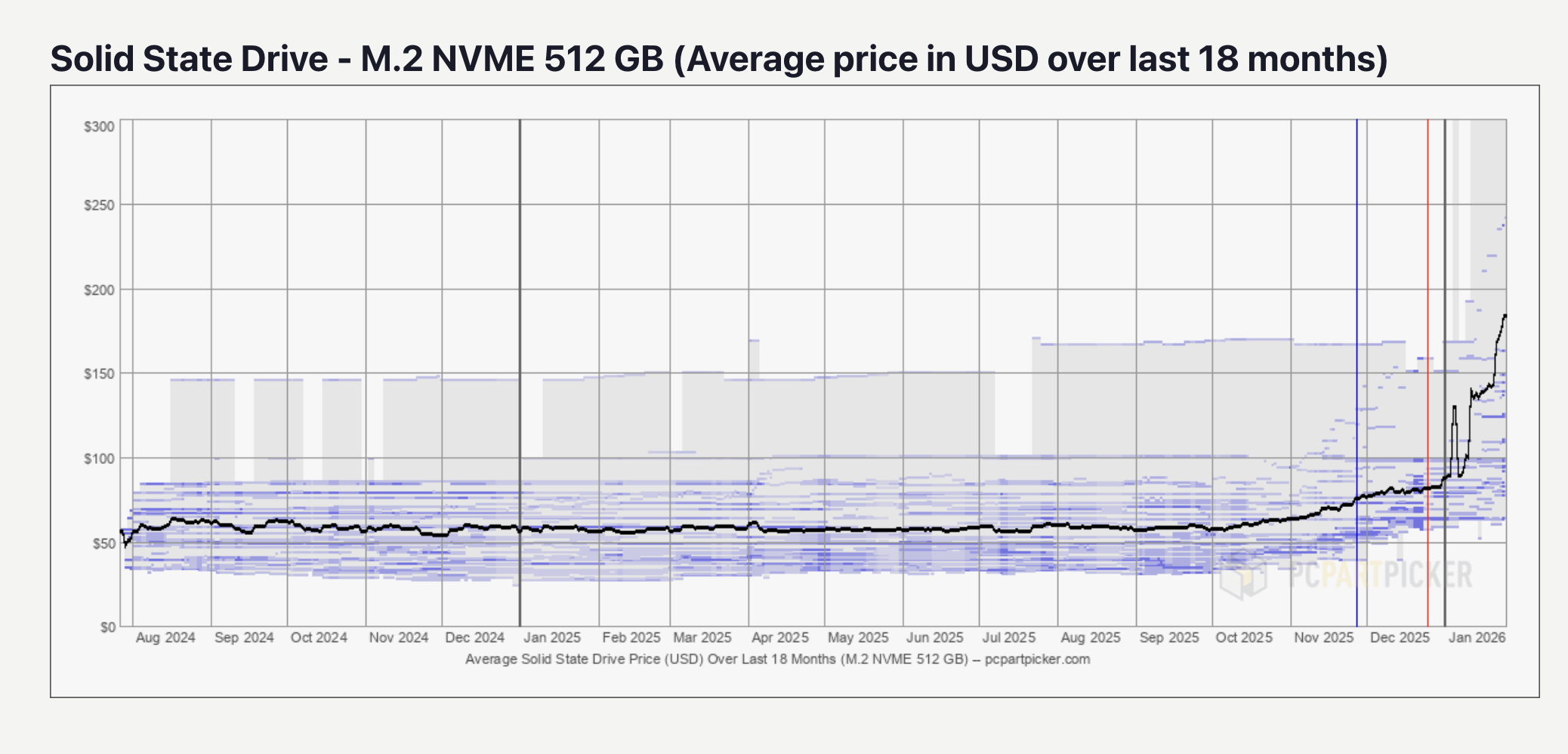

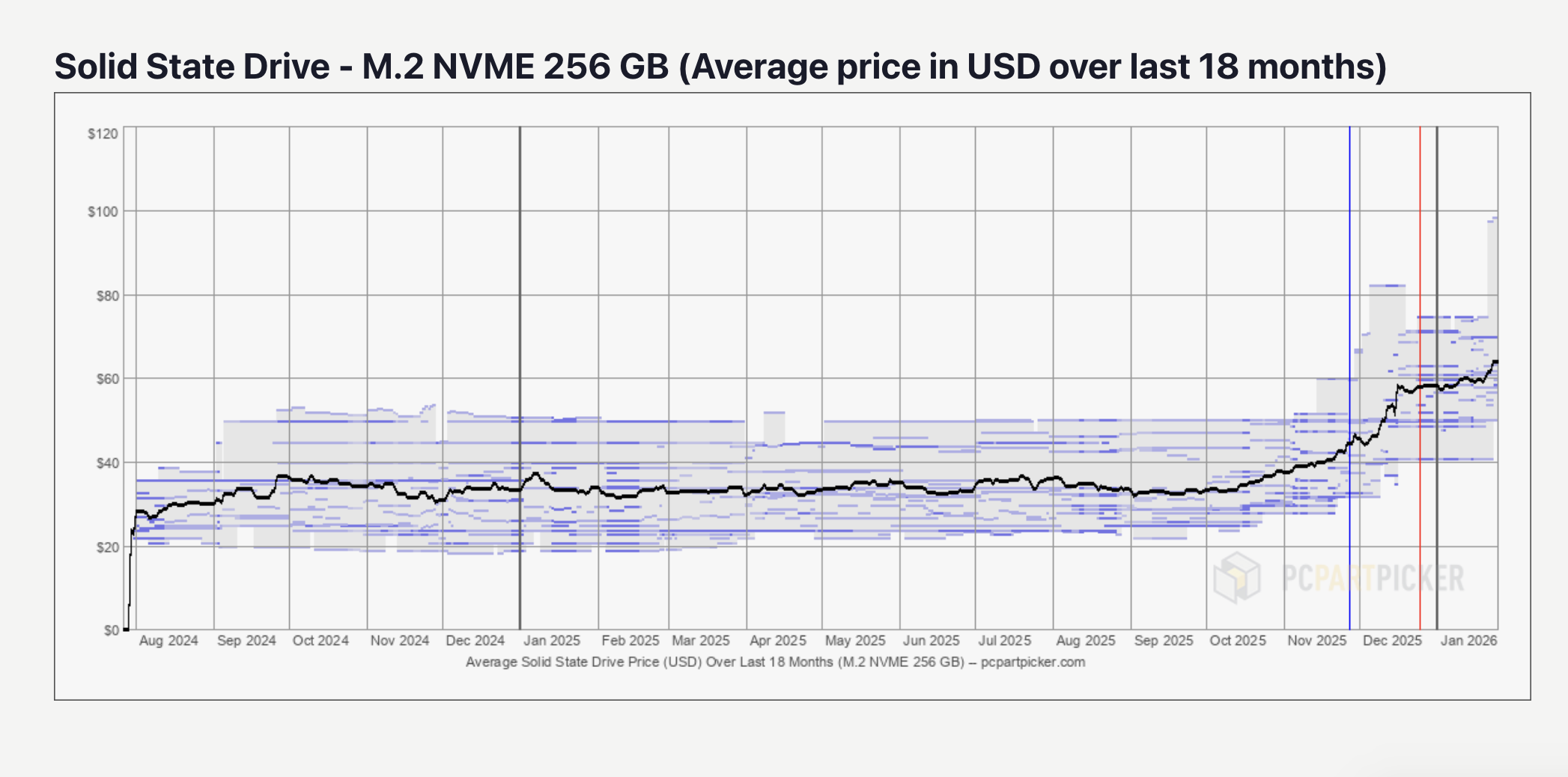

For gamers and PC builders, NAND matters because it is the cost foundation for SSDs, and SSDs are now a baseline component, not a luxury upgrade. When contract pricing doubles at the supply level, downstream impacts tend to show up fast through OEM builds, system integrators, and finally in retail listings, especially for higher capacity drives where bill of materials exposure is larger. This would also land in the same window where many players are planning 2026 upgrades around new CPU and GPU cycles, making total build cost inflation feel even more punishing.

The report also frames a broader industry reality: manufacturers are incentivized to optimize profitability across DRAM and NAND depending on margins and supply constraints. When DRAM demand is pushed upward by AI servers and high bandwidth memory adjacent capacity planning, NAND can become the lever used to protect overall earnings, even if that creates a tougher environment for consumer devices like SSDs.

From a market strategy perspective, the signal here is not just higher prices, it is reduced predictability. When core components move sharply, the traditional upgrade playbook breaks. Waiting for prices to normalize becomes less reliable, and planning a build around a fixed budget gets harder, because storage is no longer the stable part of the spreadsheet.

If you are trying to make practical decisions in this environment, the most resilient approach is to treat storage like a timing sensitive purchase. If you genuinely need capacity soon, securing the SSD now may be safer than assuming Q2 will be cheaper. If you can wait, the next best move is to avoid panic buying and instead lock your build plan, monitor pricing weekly, and be ready to pivot capacity tiers, for example 1TB versus 2TB, based on value shifts.

At a high level, this is the same story PC gamers have been living through across memory and graphics: AI driven demand is turning historically predictable components into volatility zones, and the most effective upgrade strategy becomes phased upgrades, flexible part selection, and disciplined timing rather than chasing the perfect all at once build.

If NAND pricing really jumps by 100% at the contract level, will you accelerate your SSD upgrade now, or pause all PC upgrades until the market cools down?