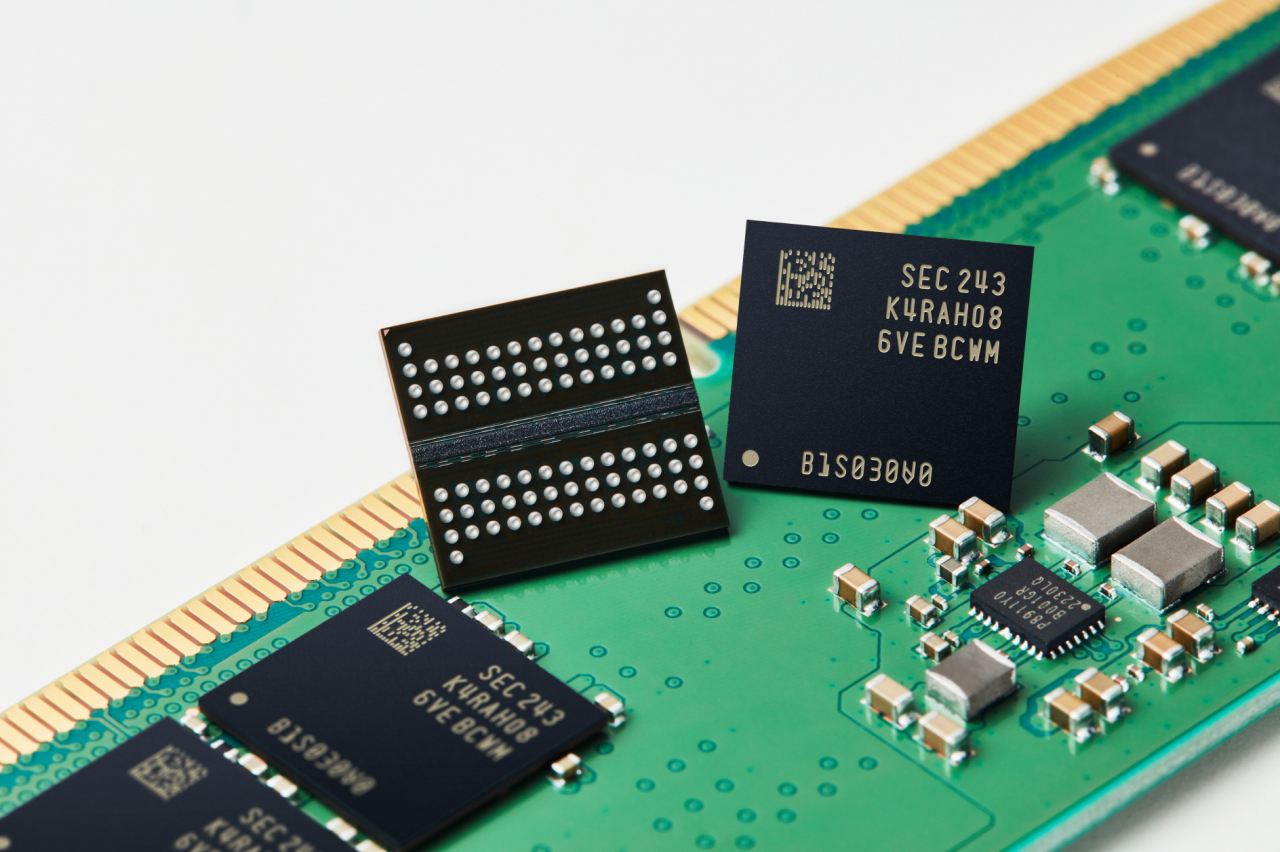

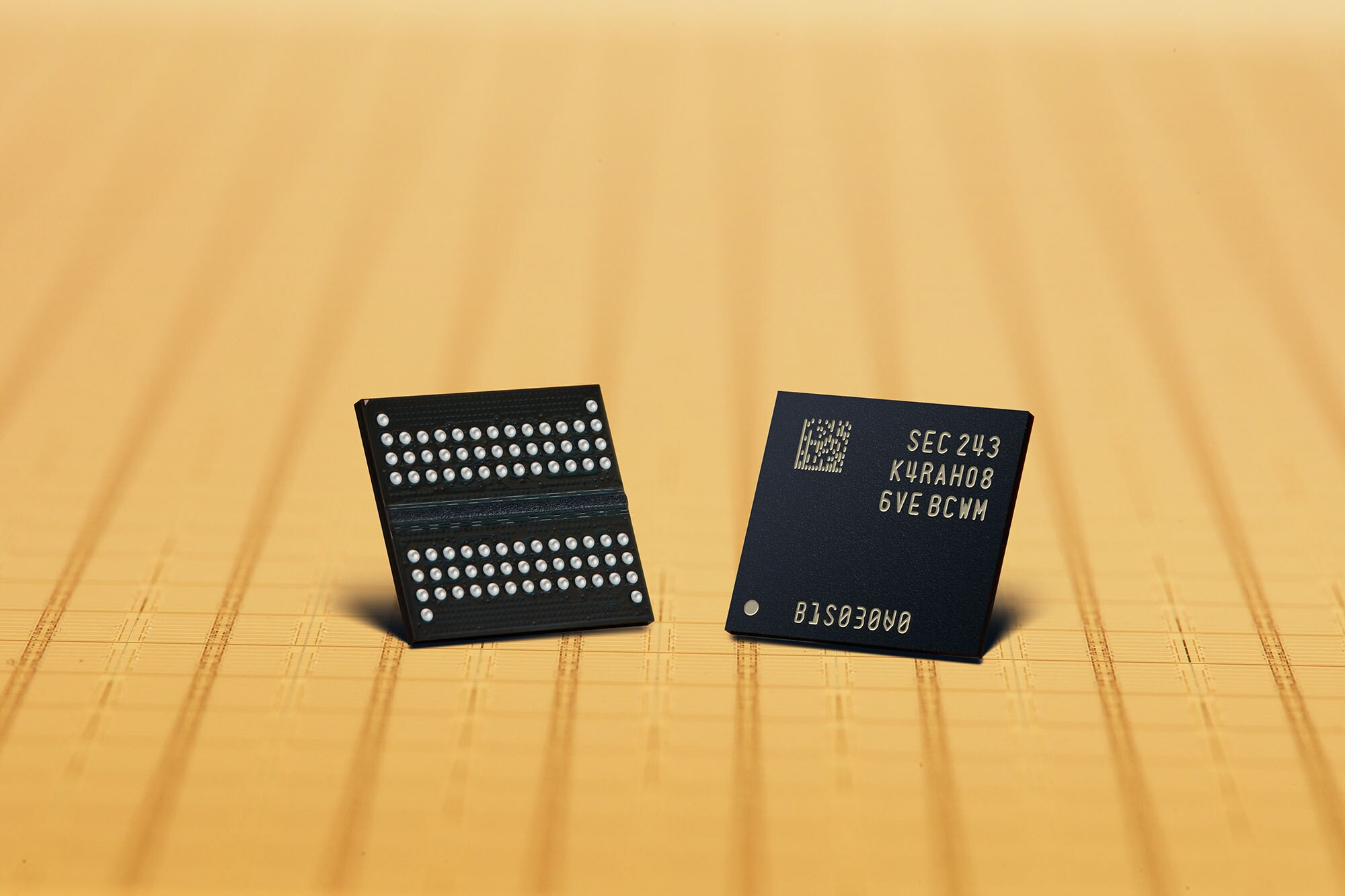

Samsung DRAM Output Growth Looks Capped at 5% in 2026, Setting Up a Longer Consumer Memory Squeeze

Samsung’s memory supply ramp is not matching the velocity of demand, and that mismatch is quickly becoming the defining constraint across the PC and device ecosystem.

Per a recent report highlighted by DigiTimes, Samsung’s total DRAM wafer output is projected to rise by about 5% in 2026, landing near 8 million wafers. That is a marginal capacity gain in a market where customer requests are widely expected to accelerate, especially from hyperscalers and AI platform builders that are aggressively scaling data center footprints.

The strategic implication is straightforward: memory makers are optimizing for margin and predictable allocation, not maximum consumer volume. With AI infrastructure pulling high value DRAM supply upstream, the consumer market is likely to remain boxed into a tighter availability window, with pricing volatility sticking around longer than most buyers want to hear.

A 5% output bump might sound material in isolation, but it becomes a bottleneck when demand growth is structurally higher. Even if Samsung executes perfectly on production and yields, the incremental wafers are unlikely to meaningfully loosen overall availability once you factor in how much capacity is being prioritized toward high performance memory products tied to AI builds.

In practical terms, this keeps pressure on:

DDR5 availability for mainstream PCs and laptops

Graphics card BOM costs where memory is a major line item

OEM configurations where vendors may quietly optimize specs to hit price targets

Samsung, SK hynix, and Micron are all incentivized to point expansion toward HBM and other high margin lines that align with hyperscaler demand. Even when new capacity comes online, it is often tuned for AI era products first, which delays relief for typical consumer DRAM supply.

That is why end users are seeing a market where demand keeps climbing but shelf reality does not improve at the same pace. The shortage narrative stops being a temporary spike and starts looking like a multi year operating condition for the broader PC market.

If Samsung holds to single digit output growth while demand keeps outpacing supply, the next pressure point becomes allocation policy and mix, not just raw wafer starts. In other words, the question shifts from how much DRAM exists to who gets it, in what form, and at what price.

If you are building or upgrading in 2026, the most practical play is to treat DRAM like a constrained component, plan purchases earlier, and lock configurations before price resets ripple through GPUs, laptops, and prebuilts.

What is your read on this memory market cycle: temporary pain or the new normal through 2027 and beyond?