PS5 Shipments Reach 92.2 Million Units as Quarterly Sales Slip Year over Year

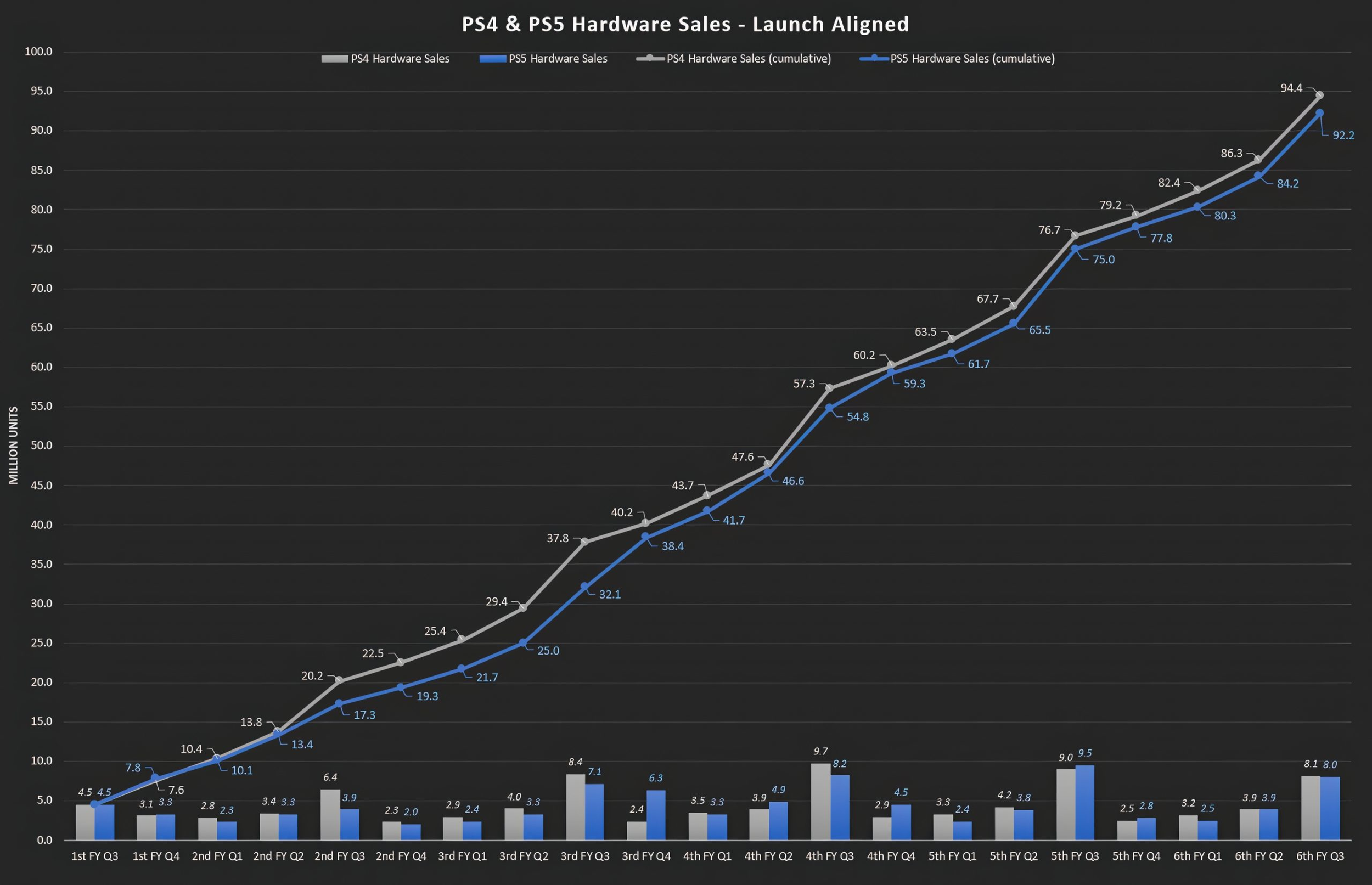

Sony’s latest quarterly disclosures show the PlayStation 5 continues to expand its installed base, even as momentum cools compared with the prior year. In its Sony quarterly financial report, Sony reports cumulative PS5 shipments have now reached 92.2 million units, up from 84.2 million units previously, implying 8.0 million PS5 units shipped during fiscal Q3.

That Q3 console shipment volume represents a year over year decline. Sony’s Q3 PS5 shipments fell 15.8% versus Q3 2024, reflecting a softer hardware quarter despite the platform remaining on a broadly healthy long term trajectory. On a fiscal year to date basis through Q3, Sony indicates total PS5 shipments for FY 2025 stand at 14.4 million units, compared with 15.7 million units at the same point in FY 2024, down 8.3%. Hardware softness is being felt while the industry navigates ongoing component pressure, and while early lifecycle constraints were defined by semiconductor availability, the current macro backdrop has shifted toward tighter memory supply and less predictable pricing.

Contextually, Sony’s cumulative PS5 shipment position remains close to PS4 at a similar lifecycle stage, with PS4 cited at 94.4 million units. The strategic read here is that Sony is still operating within a competitive band for long cycle platform performance, even if quarterly swings have become more sensitive to supply chain stress and broader consumer spending patterns.

Software is where Sony is clearly offsetting some of the hardware deceleration. Total game software sales across PlayStation 4 and PlayStation 5 reached 97.2 million units for the quarter, up 1.4% year over year. First party software performance stood out in particular, with 13.2 million first party units sold in the quarter, up 13.8% year over year from 11.6 million units.

The headline software driver was Ghost of Yōtei from Sucker Punch Productions, positioned as the biggest PS5 exclusive release of FY 2025. During the FY 2025 Q3 earnings call, Sony CFO Lin Tao said Ghost of Yōtei has exceeded the sales of Ghost of Tsushima on a launch aligned comparison. While Sony did not share an updated official unit figure, the launch pace numbers referenced paint a clear picture of stronger early velocity. Ghost of Tsushima sold 2.4 million units in its first 3 days and reached 5.0 million units 118 days after launch. By contrast, Ghost of Yōtei is cited at 3.3 million units in 32 days, indicating a faster ramp toward key early milestones even without the exceptional pandemic era demand conditions and larger install base advantages that benefitted Tsushima at release.

From a franchise strategy lens, this strengthens the business case for expansion content. With a clear early demand signal and strong first party mix contribution, it is difficult to imagine Sony leaving monetization and engagement upside on the table, especially as platform holders increasingly use premium expansions to extend sales tails and sustain monthly active users between major first party beats.

Looking ahead, Sucker Punch is scheduled to deliver the Legends online co op mode at some point in 2026. There is also speculation that Legends could align with a PC launch, though nothing is confirmed. If Sony does synchronize those beats, it would fit a broader go to market playbook: refresh interest through a meaningful content drop, widen addressable audience via PC, and keep the ecosystem flywheel turning while hardware shipments stabilize under supply conditions.

Do you see PS5’s hardware slowdown as a normal late cycle curve, or do memory shortages risk reshaping console pricing and launch pacing for the rest of 2026?