PC Makers Rush For DRAM LTAs As DDR5 Pricing Pressure Signals 2026 Supply Chain Triage

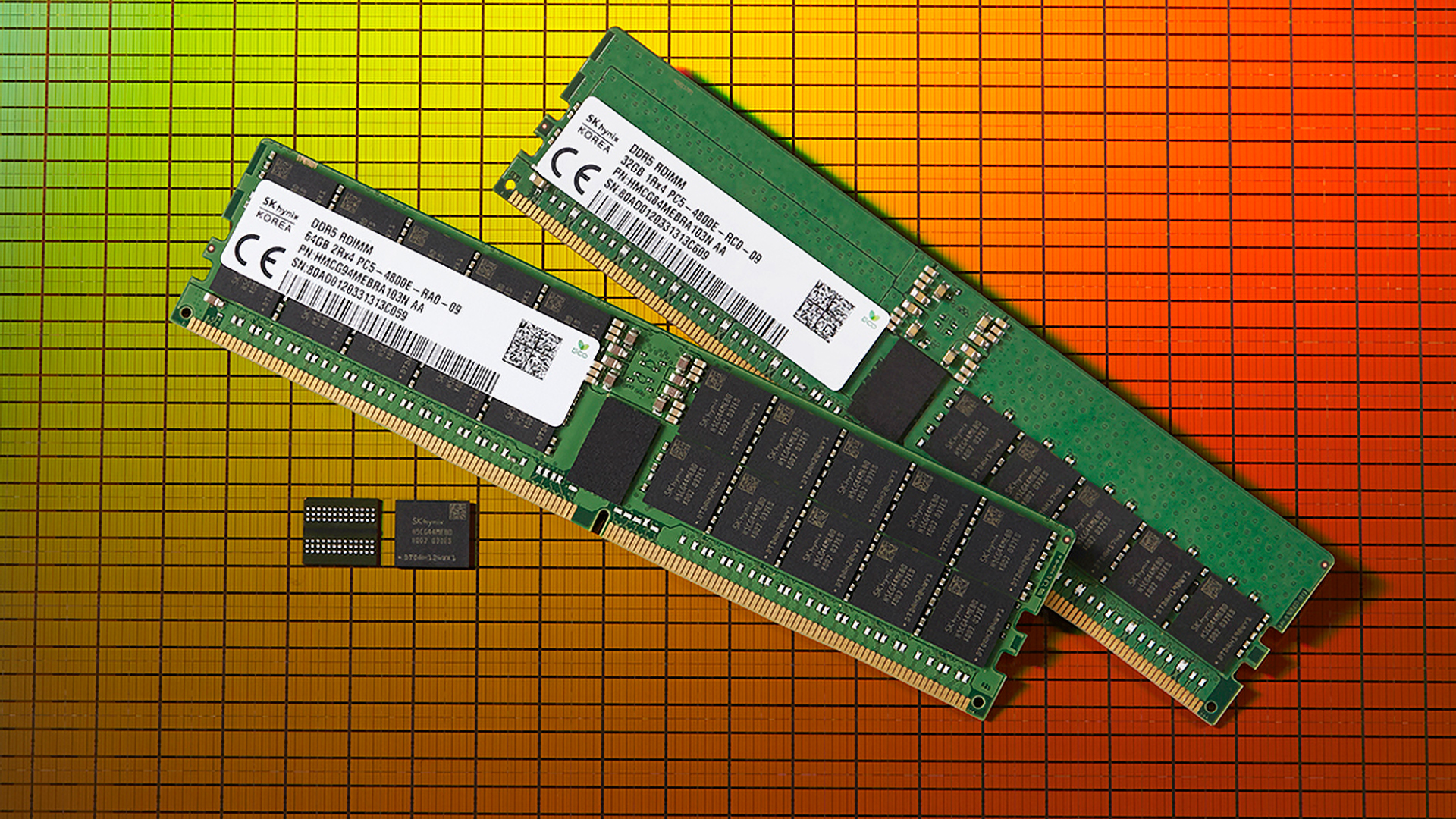

The PC industry’s memory procurement playbook is shifting from routine sourcing to crisis management, as manufacturers reportedly scramble to secure long term agreements directly with top tier DRAM suppliers while facing allocation pressure that is now impacting even the largest OEM and component brands. According to a report from Chosun Biz, DRAM supply remains severely constrained, with companies such as ASUS, HP, and Dell described as struggling to obtain stable allocations, even as they approach Samsung and SK hynix in search of contractual supply commitments.

The same report frames the market mood as nearing desperation and highlights a key driver behind the urgency: DDR5 pricing is expected to rise by up to 45% in 2026, following an already meaningful upward move that has begun to disrupt standard PC product planning. For manufacturers, this creates an uncomfortable set of tradeoffs because buying capacity at higher contract prices forces adjustments across entire portfolios, from entry level systems to premium flagships. In short, if memory becomes the bottleneck, the rest of the bill of materials becomes secondary, and product strategy starts to orbit around whatever DRAM volume can be secured.

Within that context, the report outlines 3 pragmatic options PC makers are weighing to cope with shortages.

First is raising consumer product prices. This is the most direct lever, but it carries obvious demand risk and can require wide scale price hikes that are difficult to message, particularly in value focused segments where buyers are sensitive to even modest increases.

Second is modifying configurations to stretch limited DRAM supply across more SKUs. The report points to manufacturers sticking with 8GB as the baseline for mid range laptops, despite modern software expectations increasingly treating 16GB as the practical minimum. This approach protects shipment volume in the short term but risks weakening the user experience and long term brand perception, especially as gaming, creator workloads, and AI assisted applications become more memory hungry.

Third is delaying product launches. The report suggests this is already happening and implies it may become a standard response across categories, with the industry preparing for postponed releases or scaled down premium lineups as a necessary market response strategy. It also references an outlook where next generation roadmaps could slip simply because DRAM allocation timing dictates what can be built at scale and when.

The downstream implication is a supply chain that behaves less like a steady pipeline and more like rationing under constraint. The report indicates that major GPU and CPU vendors are already aligning their retail product plans around memory allocations they have locked in, which could translate into a longer retail lifespan for current generation lineups and fewer clean generational handoffs than enthusiasts typically expect. If this continues, the industry could face a period where innovation exists on paper, but availability and pricing determine what actually reaches shelves, and at what volume.

For gamers and builders, this memory driven squeeze is a silent meta boss that affects more than RAM kits. When DRAM is scarce and expensive, it can influence laptop base configurations, prebuilt pricing, GPU refresh timing, and even SSD pricing indirectly through NAND demand dynamics tied to AI infrastructure. The strategic question for 2026 becomes less about who has the fastest new silicon and more about who can secure enough memory supply to ship products at sustainable margins.

Do you think OEMs should hold the line on 16GB as the mainstream baseline even if it forces higher prices, or is an 8GB baseline acceptable as a temporary shortage era compromise?