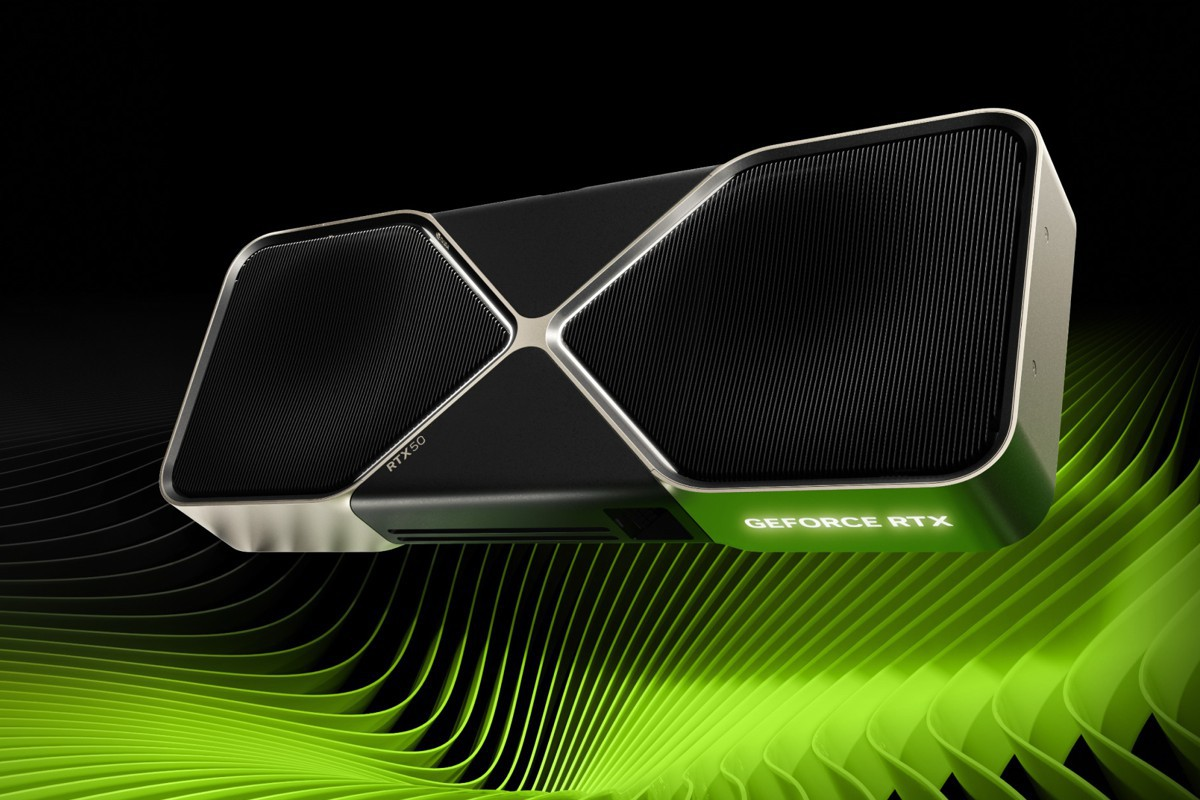

NVIDIA Reportedly Skips RTX 50 SUPER in 2026 as Memory Shortages Ripple Into RTX 60 Rubin Timeline and RTX 50 Supply

NVIDIA’s consumer GPU roadmap is reportedly hitting a hard reality check as the PC industry’s memory supply constraints continue to distort product planning, pricing, and production priorities. A report from The Information says NVIDIA has no plans to launch a new gaming GPU this year, a claim that, if accurate, effectively takes the expected RTX 50 SUPER refresh off the table for 2026 and signals a more defensive posture for GeForce in the near term.

The most immediate impact is on expectations. The RTX 50 SUPER line has been widely treated as the next logical consumer facing step, especially with many watchers anticipating an announcement window aligned with early year hardware showcases. Instead, the reporting indicates NVIDIA is reshaping priorities around memory availability and allocation, with the underlying issue not being GPU silicon readiness alone, but the ability to secure enough memory at viable cost and volume to support a refresh cycle without destabilizing margins and channel supply.

At the same time, the report and follow on coverage suggest NVIDIA is also cutting production of existing RTX 50 series products. That matters for gamers far more than any naming cycle, because reduced output in the current generation tends to translate into tighter retail availability and stickier pricing in the channel, especially for high demand SKUs. In other words, even without a new launch, the market can still feel worse if supply is being deliberately constrained while demand holds.

The longer tail risk is the domino effect into the next generation. Coverage tied to the same Information reporting suggests RTX 60 Rubin, which had been associated with a late 2027 mass production window, could slip further if memory constraints persist, pushing the next major GeForce generation into 2028 or later. If that happens, it would represent one of the longest gaps in modern GeForce cadence and would reshape how AIB partners, system builders, and OEMs plan product stacks, especially for midrange gaming desktops where value is highly sensitive to GPU price and availability.

Strategically, this maps to a simple incentive structure. AI and data center demand remains more attractive for NVIDIA, and memory supply is a shared constraint across multiple product lines. When memory is scarce and expensive, prioritizing higher margin, higher demand infrastructure products becomes the rational move, even if it creates frustration on the consumer side. The consequence is that GeForce may see fewer mid cycle refreshes, fewer price corrections, and a longer lived generation, all while cloud and subscription options become more appealing for players who cannot justify inflated component pricing.

There is still room for consumer adjacent activity. The same broader reporting environment points to NVIDIA’s ARM based PC efforts such as N1X as a potential area that could still see motion because it sits inside the AI PC narrative rather than the traditional discrete GPU refresh loop. But for pure gaming GPUs, the reported takeaway is blunt: 2026 may be a holding pattern year, and pricing pressure could remain elevated if RTX 50 production is indeed being reduced while a refresh is pulled forward.

If RTX 50 pricing stays inflated and RTX 50 SUPER does not arrive in 2026, would you pivot to cloud gaming for big releases, or hold the line and wait for a true next generation jump?