NVIDIA Reportedly Demands Full Upfront Payments for H200 Orders in China to Hedge Against Policy Uncertainty

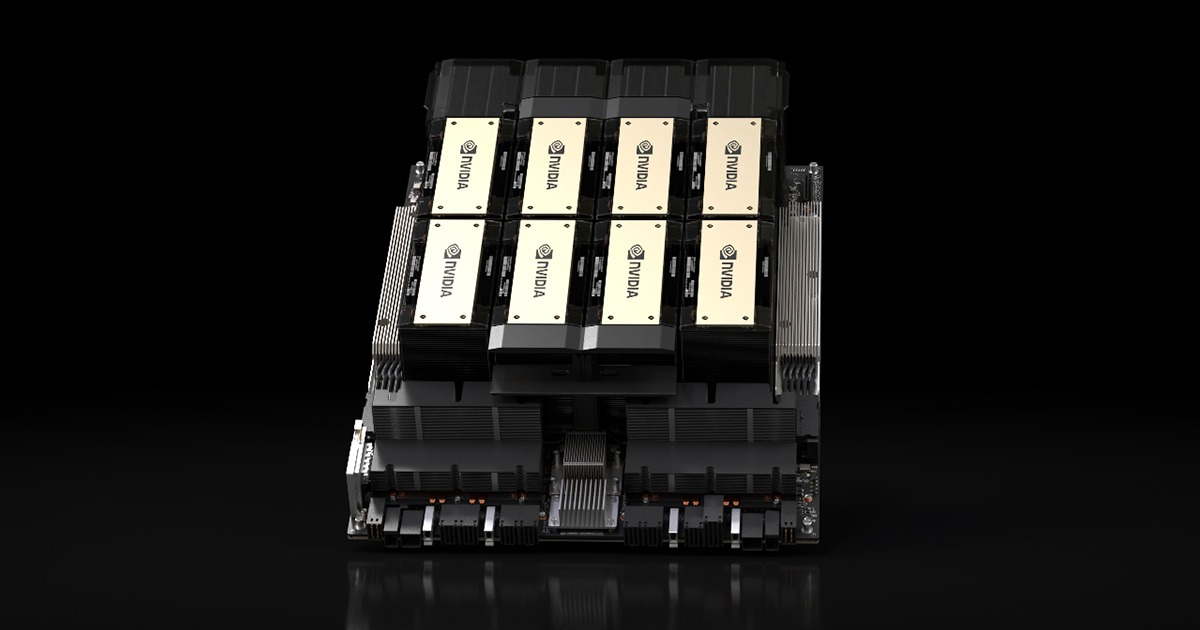

NVIDIA is reportedly tightening its commercial terms for China bound AI accelerator orders, aiming to reduce exposure to sudden policy shifts and order volatility across both United States export controls and China side regulatory enforcement. According to a new report from Reuters, NVIDIA is requiring Chinese customers purchasing H200 AI chips to pay in full upfront, with no cancellations, modifications, or changes after an order is placed.

The report frames the move as a direct risk hedge against uncertainty that has increasingly defined NVIDIA’s China business in recent months. Your draft highlights a recent example of that whiplash dynamic, where after the United States lifted restrictions around the H20 AI chip, China then moved to limit access through tighter policy and regulatory pressure aimed at domestic hyperscalers. In that environment, NVIDIA’s priority shifts from flexible booking to guaranteed commitment, especially for a product line that sits at the center of the current frontier model compute race.

Operationally, the logic is straightforward. A full prepayment model de risks production planning for a constrained, high value supply chain, particularly when NVIDIA needs to allocate wafer capacity and packaging resources in a predictable way. In your draft, Chinese AI leaders are described as preparing potential demand for up to 2000000 H200 chips, a volume that would exceed readily available inventory and would force suppliers to align capacity ramps with real purchase certainty rather than tentative forecasts. This is the same playbook used across high constraint cycles: lock demand, stabilize manufacturing cadence, then ship against commitments that cannot disappear overnight.

However, the approach also shifts risk onto customers inside China. If policies change suddenly and access to imported high end accelerators is disrupted, customers holding fully prepaid orders could find themselves exposed to delays or restrictions without the normal ability to adjust configurations or cancel. That is a material friction point in a market where regulatory posture can change quickly and where internal guidance can reshape procurement priorities with limited notice.

The timing also matters because NVIDIA is balancing multiple platform priorities at once. While Hopper class products like H200 remain strategically important for current deployments, the broader roadmap focus is moving toward newer cycles, including Blackwell Ultra and Vera Rubin as referenced in your draft. For upstream partners such as TSMC, sustaining Hopper related demand would require continued allocation to nodes like 4nm, which becomes a capacity planning challenge when the supply chain is also preparing for next generation ramps.

For Chinese buyers, the leverage situation remains complicated. Domestic options are improving, but demand for NVIDIA’s ecosystem, software maturity, and high end performance means many customers may still have limited alternatives in the near term for frontier scale training and deployment. That reality increases the likelihood that customers comply with stricter payment terms, even if the policy environment remains unstable.

If NVIDIA enforces no cancellation full prepayment terms for China bound H200 orders, do you see this as smart supply chain risk management, or a move that will push Chinese AI firms to accelerate a longer term shift toward domestic alternatives?