Samsung Related Distributors Allegedly Signal Up To 80% Memory Price Hike as Supply Discipline Tightens

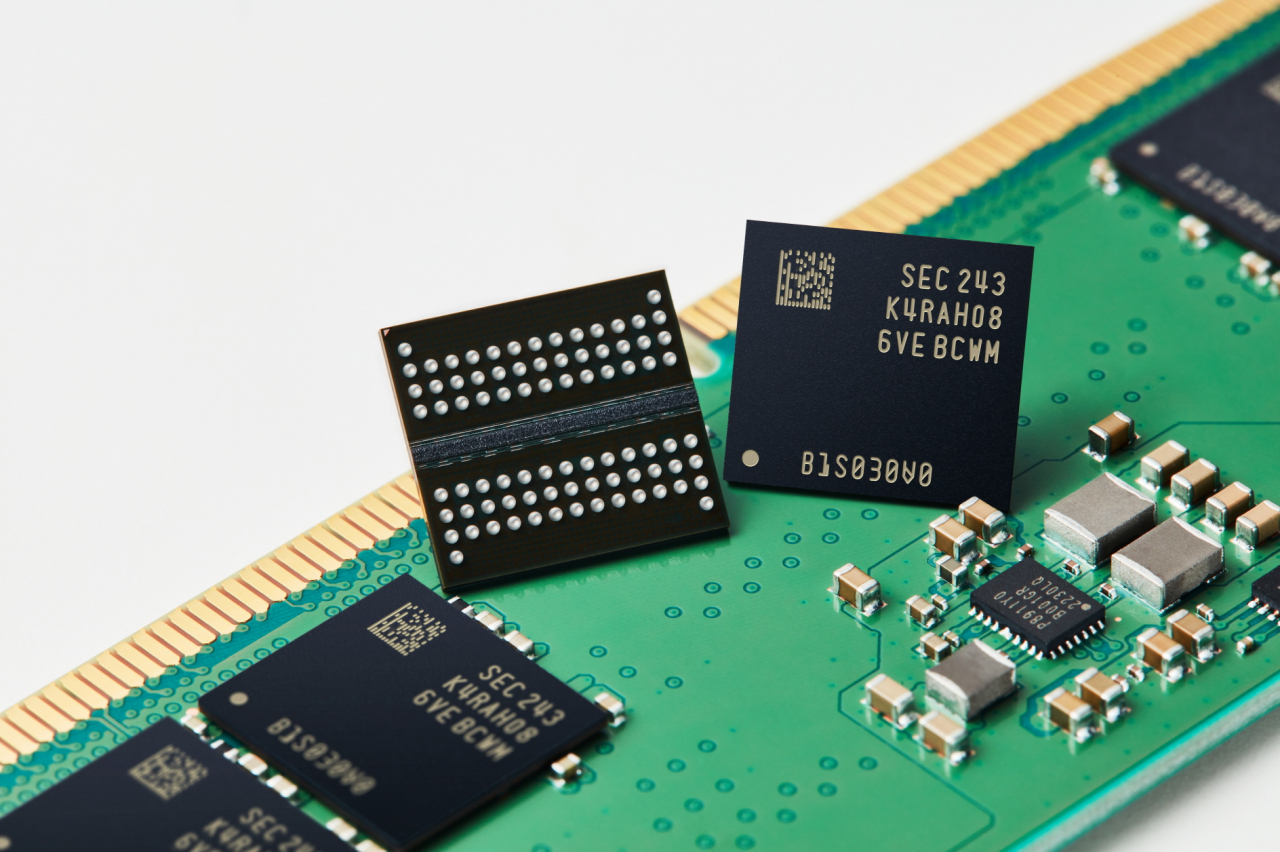

Samsung related distributors and dealerships are reportedly preparing aggressive memory pricing increases, with a circulating notice suggesting prices across Samsung memory products could rise by as much as 80%. The claim is spreading via social media, alongside an image of an alleged distributor communication stating that prices for all Samsung memory products will increase by up to 80%. For reference, the circulating post can be viewed via the QQ Timmy X post.

價格調整通知 - 三星(Samsung)

— 駿HaYaO (@QQ_Timmy) January 22, 2026

敬愛的貴賓客戶:

感謝您一直以來對我們的信賴與支持。

作為三星記憶體產品的授權經銷商/代理商,我們在此正式通知您:由於全球半導體市場發生重大變化,包括供應持續受限以及上游製造成本大幅上漲,三星已正式宣布進行價格調整。… https://t.co/YNsGdAj187 pic.twitter.com/uTBqhpfU25

At this stage, the key detail is verification. The notice itself has not been independently confirmed, and the conversation appears to be driven by screenshots and secondary sourcing rather than a formal public announcement from Samsung. Adding to the narrative, a separate post points to an employee connected to DS Giheung as the purported origin point of the information circulating online. DS Giheung is commonly used to refer to Samsung Electronics Device Solutions campus in Giheung, South Korea.

If the 80% figure holds any weight, even as a maximum ceiling rather than a uniform increase, the implications would be immediate for system builders, OEMs, and channel partners. Memory is a core cost component that touches almost every segment, from mainstream consumer PCs to high density enterprise platforms. A sudden channel level repricing also tends to create short term purchasing spikes, followed by demand elasticity as buyers reassess build plans, refresh cycles, and inventory strategy.

The broader market context being referenced alongside the alleged notice is supply discipline. The report suggests Samsung is planning only a 5% DRAM output increase this year, despite strong demand and more frequent supply bottlenecks. The underlying logic being implied is that manufacturers may be attempting to avoid repeating prior boom and bust cycles, especially if AI driven demand for high bandwidth memory eventually slows from its current trajectory. At the same time, the narrative being pushed in the discussion is that pricing power is becoming a strategic lever, with the market reading cautious supply expansion as a way to protect margins during a high demand phase.

This pricing conversation is not limited to DRAM. The same coverage claims NAND supply could also tighten if vendors prioritize higher profitability DRAM production and shift resources away from NAND lines. Samsung has reportedly provided the standard corporate response to inquiries, stating that it does not comment on industry rumors and speculation.

A final data point being used to frame the stakes is a TrendForce estimate cited by EET China suggesting the overall output value of the memory industry could reach {United States 551.6 billion dollars: 551.6B$} in 2026 and rise to {United States 842.7 billion dollars: 842.7B$} in 2027, implying over 53% year over year growth. That reference is published in the EET China report. If the market believes that kind of expansion is realistic, it also explains why channel and suppliers may test how much pricing the ecosystem can absorb, particularly in categories tied to AI infrastructure and premium client devices.

For now, the smartest way to read this is as a high signal rumor with real channel risk, not a confirmed pricing policy. If you are buying memory in the near term, the practical play is to monitor official price lists from your distributors and watch whether multiple independent channels echo the same increase, because a single screenshot is not proof, but coordinated movements across regions usually are.

What are you seeing in your local channel right now, stable pricing, small bumps, or sudden jumps that feel like a coordinated move?