PC and Server Memory Plus NAND Prices Surge Over 90% in Q1 2026, With Counterpoint Pointing to Additional Q2 Hikes

The memory market is not just heating up, it is rewriting the pricing baseline in real time. A new report from Counterpoint Research says both DRAM and NAND pricing has surged by roughly 80% to 90% in Q1 2026 so far versus Q4 2025, with multiple segments hitting record highs. Counterpoint’s analysis is based on its internal memory price tracker and focuses on how the ongoing DRAM and NAND shortages are squeezing both the PC and server supply chains while simultaneously driving profitability for memory manufacturers.

According to Counterpoint, memory prices have soared 80% to 90% in Q1 2026 so far compared to Q4 2025, with DRAM, NAND, and HBM reaching record breaking highs. The report also notes that OEMs are already responding tactically by reducing memory content per device or prioritizing premium lineups equipped with LPDDR5, where pricing pressure is described as relatively more manageable. That shift is a clear signal that vendors are trying to defend margins while still keeping products moving in a market where consumer purchasing power is not improving at the same pace as component costs.

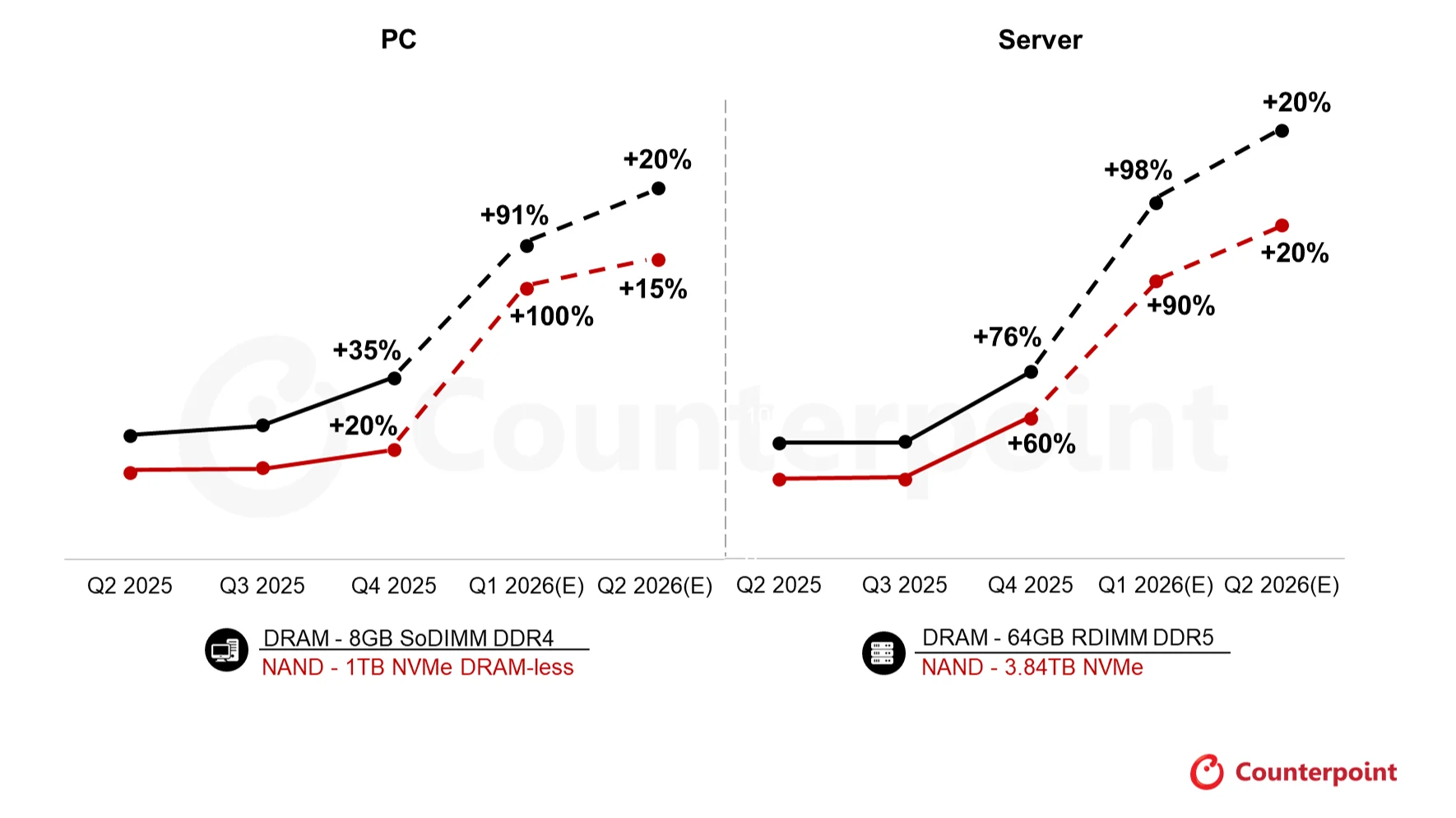

Counterpoint’s breakdown is especially blunt when you compare the prior quarter to the current one. In Q4 2025, PC memory pricing saw increases around 35%, while PC NAND rose about 20%. The server side was already in far worse shape, with memory up roughly 76% and NAND up about 60%. For Q1 2026, Counterpoint estimates PC memory and NAND pricing reaching over 90% and 100% respectively, while server memory and NAND are estimated at over 98% and 90% respectively. If those estimates hold through the remainder of the quarter, it marks a rapid escalation where both client and data center components are effectively doubling in cost on a quarter to quarter basis.

The report then points to what may come next. Counterpoint estimates an additional 15% to 20% average price hike for Q2 2026, which matters because it suggests the market is not simply peaking and stabilizing. Instead, it is grinding upward in waves, driven by constrained supply and demand pull from large scale compute and AI infrastructure buildouts.

Senior Analyst Jeongku Choi also framed the situation as a dual pressure event for device makers, describing rising component costs combined with weakened consumer purchasing power as a combination that can slow demand as the quarter progresses. In his view, this is precisely why OEMs may need to adjust procurement patterns and emphasize premium models that can justify higher pricing through clearer value delivery. Counterpoint also highlights the profitability side, noting that DRAM operating margins reached the 60% range in Q4 2025 and that Q1 2026 is expected to push margins beyond historical peaks, with general purpose DRAM margins even surpassing HBM in that earlier quarter. The implication is that suppliers are not incentivized to ease pricing quickly because the current market structure is producing unprecedented earnings.

Counterpoint’s data also aligns with what many builders and gamers are feeling in the channel. Even if averages are one thing, real world retail behavior can be harsher. Some higher end DDR5 kits have already moved into multiples versus their Q4 2025 pricing, and NAND is increasingly following the same trajectory rather than acting as the cheaper stabilizer it used to be in mainstream builds.

For PC gamers, creators, and anyone planning a platform upgrade in 2026, the strategic takeaway is that the pricing pain is not just a short spike. It is becoming an operational reality that forces trade offs, such as smaller default memory configurations, premium tier upsells, and delayed refresh cycles. Even if there are brief periods where pricing appears to flatten, Counterpoint’s report reinforces that the underlying supply and demand mismatch is still in control.

If Q2 2026 brings another 15% to 20% average hike, would you downsize your next build’s memory and storage configuration, or pay the premium to maintain the performance target you