NVIDIA H200 Shipments to China Reportedly Blocked at Customs, Adding Fresh Uncertainty to an Already Volatile Channel

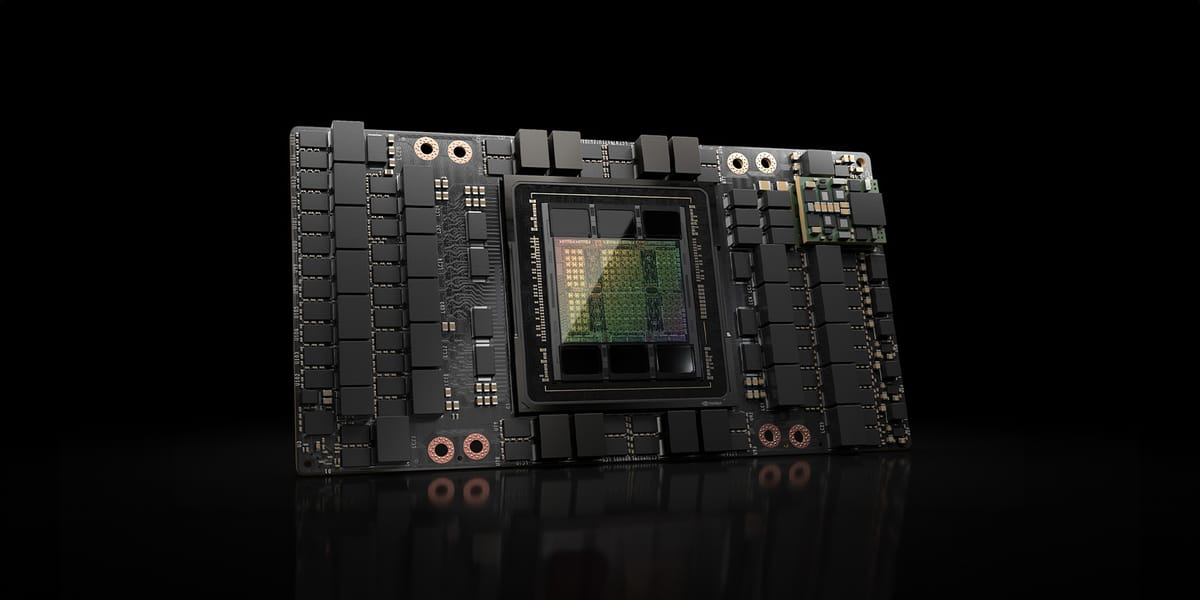

NVIDIA’s China facing AI accelerator strategy is back in the spotlight after a new Reuters report claims Chinese customs authorities have instructed agents that H200 chips are not permitted for import, effectively freezing shipments despite recent signals of a possible policy thaw. This development lands in the middle of rapid policy recalibration on both sides. Over the past several weeks, the United States has moved from discussion toward conditional approvals and eased handling for H200 exports to China, while Beijing’s posture now appears to be tightening at the border.

According to Reuters, customs guidance delivered to agents is being described in unusually strict terms, to the point that it functions as a de facto ban in the near term, even if the situation is not yet framed as a formal permanent prohibition. Reuters also reports that Chinese officials have warned domestic technology companies against purchasing the chips unless absolutely necessary, reinforcing the chilling effect on demand and logistics.

At the same time, Reuters notes there have been discussions around potential exemptions, with some imports possibly allowed under narrow conditions such as research and development use, which aligns with earlier chatter that case level review could be part of the playbook.

From a market execution perspective, the key point is that the bottleneck is no longer purely about customer appetite or NVIDIA’s willingness to supply. It is increasingly about government gatekeeping and enforcement variability. Reuters frames Beijing’s motivations as unclear, with possibilities ranging from support for domestic chip development to using the restriction as a negotiating lever amid broader United States China dynamics.

This political overlay has been building for months. In 2025, remarks from a United States official about making Chinese engineers “addicted” to the American technology stack became a flashpoint in China facing semiconductor narratives, underscoring how rhetoric can quickly become policy gravity.

Because this situation is moving fast and involves enforcement behavior at ports of entry, the highest confidence datapoint currently available is what Reuters attributes to sources familiar with the instructions given to customs agents. That is credible directional evidence of an immediate operational stop, even if the long term ruleset may change again as negotiations and export control frameworks evolve.

The practical implication is clear: even with United States side approvals that include conditions and compliance guardrails, shipments can still stall if China side clearance is not granted or is actively discouraged.

If you are tracking this as a market story, the near term theme is execution risk. Policy uncertainty is now an explicit variable in NVIDIA’s China revenue visibility, hyperscaler deployment timelines, and the broader AI infrastructure supply chain.

Did you expect China to tighten customs enforcement even as the United States signaled more flexibility, or does this feel like a predictable next step in the AI chip chess match? Share your take in the comments.