NVIDIA Faces H200 Supply Crunch as China Orders Reportedly Hit 2 Millions Units, Forcing TSMC Capacity Decisions

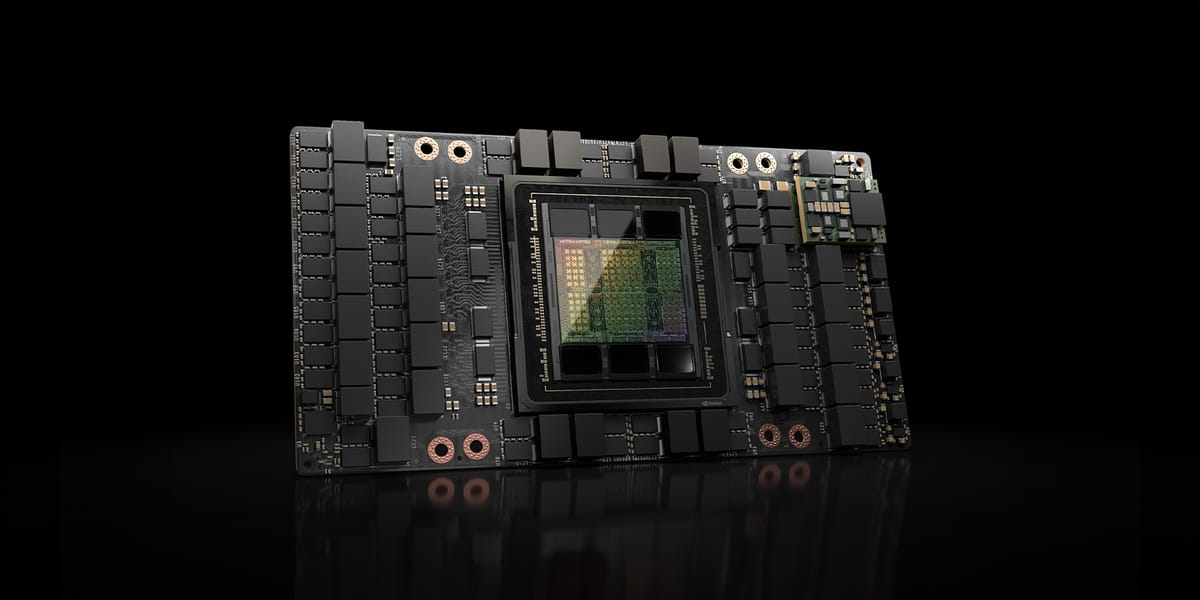

NVIDIA is reportedly running into a major supply chain bottleneck as demand from Chinese customers for its Hopper based H200 accelerates faster than available inventory, pushing the company to explore additional production with TSMC. According to a Reuters report, Chinese firms have placed orders for up to 2,000,000 H200 chips for 2026, while NVIDIA’s current inventory is said to be around 700,000 units, creating a supply gap that could require a renewed production ramp.

The strategic issue here is not simply wafer output. The Reuters report highlights that NVIDIA has approached TSMC about producing additional H200 units, with work expected to begin in Q2 2026. In practical terms, this puts pressure on a supply chain that is already balancing multiple high demand GPU programs, and it raises the risk of further tightening across global AI accelerator availability if capacity allocation becomes a zero sum game.

On pricing, Reuters estimates an H200 price point in China of roughly {United States 27000 dollars: 27000$} per chip. If the 2,000,000 unit order volume is even close to accurate, the revenue gravity is enormous, and it helps explain why NVIDIA would be motivated to pull every lever available across foundry and packaging partners to avoid leaving that demand on the table.

The more important industry read is what this implies about the shape of the AI hardware market going into 2026. Demand is not only rising, it is spiking unevenly across regions, and that forces NVIDIA and its partners to optimize for supply chain throughput, regulatory compliance, and customer prioritization at the same time. Reuters also notes the situation could raise concerns around broader supply constraints as NVIDIA works to balance China demand against availability in other markets.

For the ecosystem, the takeaway is clear: when orders outpace inventory at this scale, the constraint is no longer just a product launch cycle, it becomes a capacity planning problem that can influence lead times, pricing leverage, and the competitive tempo of AI infrastructure buildouts.

Do you think NVIDIA will prioritize fulfilling China demand first if capacity is limited, or will it ring fence supply for existing hyperscaler commitments in other regions?