NVIDIA CEO Privately Questions OpenAI Discipline as $100 billion Megadeal Reportedly Stalls

A new report from the The Wall Street Journal suggests the headline grabbing $100 billion arrangement between NVIDIA and OpenAI has not been finalized and may be cooling materially behind the scenes, despite earlier industry chatter framing it as a massive multi gigawatt compute supply commitment that would further lock OpenAI into NVIDIA’s next generation infrastructure roadmap.

The core signal in the reporting is not only timing, but confidence. According to the Wall Street Journal, NVIDIA chief executive Jensen Huang has privately criticized OpenAI’s business approach, describing a perceived lack of discipline, and raising questions about whether OpenAI’s commitments and growth narrative will translate into the kind of predictable execution that infrastructure scale deals demand. That matters because deals of this magnitude are not purely about buying GPUs. They are about multi year planning, utilization certainty, and ecosystem alignment across hardware, software, and deployment partners. If any one layer looks unstable, the risk profile changes immediately.

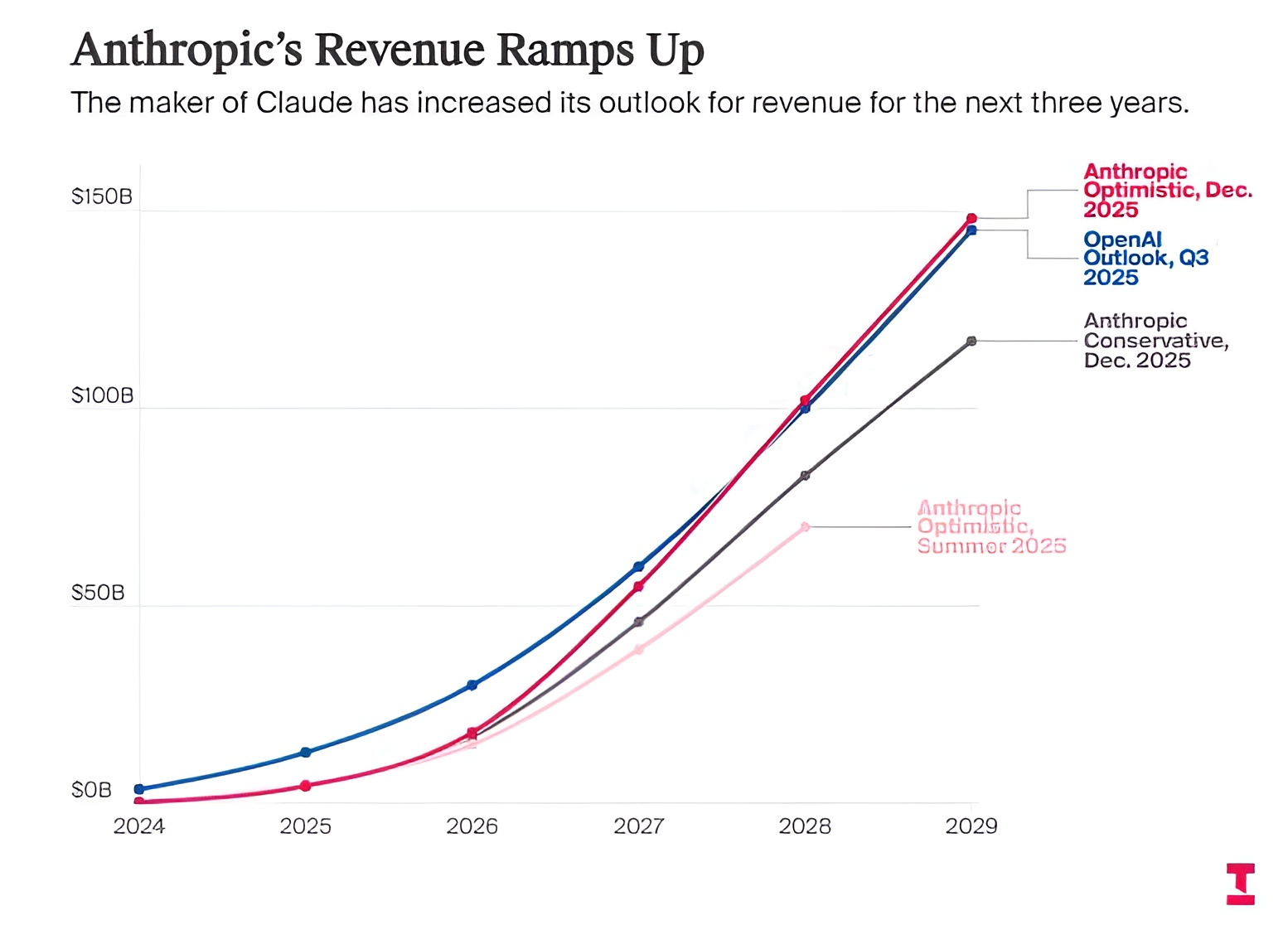

The report also highlights an increasingly competitive landscape that could influence how NVIDIA evaluates strategic concentration risk. NVIDIA is said to view OpenAI’s rivals as gaining ground, specifically calling out Anthropic and Google as sharpening their offerings and accelerating their application layer momentum. In practical terms, this speaks to a shift in perceived gravity at the application layer, where distribution, developer adoption, enterprise packaging, and monetization clarity can matter as much as model capability when deciding who will consume the most compute over the next several quarters.

There is also a disclosure layer that makes this situation more than rumor fuel. NVIDIA has already stated in a 10 Q filing that its arrangement with OpenAI is nonbinding and that there is no assurance it will proceed. That language is standard risk management, but in this context it reads like a deliberate signal to the market that nothing should be treated as locked until contracts are executed and deployment timelines are committed.

On OpenAI’s side, the pressure is multi directional. The lab has to defend mindshare in the consumer and developer ecosystem, keep enterprise momentum strong, and show a clean path to durable revenue if it is indeed targeting an IPO. If the company is also exploring advertising inside its chat product, that reinforces a broader market reality: AI leaders are being forced to prove business model resilience, not just technical leadership. That is exactly the kind of friction point that a hardware supplier like NVIDIA will weigh when deciding how aggressively to allocate capacity, pricing, and long term support.

The big picture takeaway is that the relationship is likely not breaking, but it may be being re priced and re scoped. NVIDIA has every incentive to sell compute into the frontier, but it also has every incentive to avoid overexposure to a single customer narrative if competitive dynamics are shifting quickly. In a market where compute is the currency, discipline and predictability are the credit score.

Do you think this is NVIDIA applying smart risk control before committing capacity, or is it a warning sign that OpenAI’s business model is becoming harder to defend as competition tightens?